Sears 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.during fiscal 2005, 2) a curtailment gain of $27 million ($17 million after tax or $0.12 per diluted share) related

to certain amendments made to Sears Canada’s post-retirement benefit plans, and 3) a $20 million ($12 million

after tax or $0.09 per diluted share) dividend we received on our investment in Sears Mexico. In addition, we

recorded investment losses of $14 million ($9 million after tax or $0.06 per diluted share) for fiscal 2007 on our

total return swap investments (see the “Interest and Investment Income” section below for further details).

For fiscal 2006, earnings per share included the following significant items: 1) pre-tax gains of $74 million

($45 million after-tax or $0.29 per diluted share) derived from our investments in total return swaps, 2) a $36

million pre-tax gain ($22 million after-tax or $0.14 per diluted share) recorded by us for the aggregate amount

received by Holdings in June 2006 as part of the settlement of Visa/MasterCard antitrust litigation, 3) a tax

benefit of $31 million ($0.20 per diluted share) related to the resolution of certain income tax matters, and 4) a

pre-tax charge of $74 million ($45 million after-tax or $0.29 per diluted share) related to an unfavorable verdict

in connection with a pre-Merger legal matter concerning Sears Roebuck’s redemption of certain bonds in 2004.

See Note 20 of Notes to Consolidated Financial Statements for further information regarding this matter.

All three fiscal years were impacted by gains recorded on the sale of our assets. These pre-tax gains

amounted to $38 million ($22 million after tax and minority interest or $0.15 per diluted share) in fiscal 2007,

$82 million ($50 million after-tax or $0.32 per diluted share) in fiscal 2006, and $39 million ($25 million

after-tax or $0.16 per diluted share—reported, $25 million after-tax or $0.15 per diluted share—pro forma) in

fiscal 2005. Additionally, fiscal 2006 and 2005 were impacted by restructuring charges. These pre-tax charges

were $28 million ($14 million after-tax or $0.09 per diluted share) in fiscal 2006, and $111 million ($54 million

after-tax or $0.35 per diluted share—reported, $53 million after-tax or $0.33 per diluted share—pro forma) in

fiscal 2005. The charges for both fiscal 2006 and fiscal 2005 were recorded in connection with the Merger and

integration of Sears’ and Kmart’s headquarters support functions, as well as in connection with productivity

initiatives at Sears Canada. Further details pertaining to these restructuring charges are set forth in Note 6 of

Notes to Consolidated Financial Statements.

Fiscal 2005 net income included an after-tax charge of $90 million ($0.59 per diluted share—reported,

$0.55 per diluted share—pro forma) for the cumulative effect of a change in accounting for certain indirect

overhead costs included in inventory. Further details pertaining to this cumulative effect charge are set forth in

Note 3 of Notes to Consolidated Financial Statements.

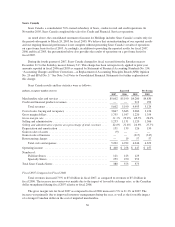

Total Revenues and Comparable Store Sales

Fiscal 2007 domestic comparable store sales were down 4.3% in the aggregate, with Sears Domestic

declining 4.0% and Kmart declining 4.7%. In the current year declines were experienced across most major

merchandise categories reflecting increased competition, the impact of a deteriorating housing market, the

increased costs of consumer staples and a decrease in consumers’ disposable income. In fiscal 2007, notably

larger declines within the home appliance and apparel categories were partially offset by increased sales of

consumer electronics. We believe that the decrease in sales in the home appliance category is directly related to a

25% decrease in new residential housing starts during 2007, as noted by U.S. government census data. We also

believe that the sales decreases reflect the impact of a larger than normal increase in the inflation rate during

2007 (4.1% as measured by the consumer price index), which negatively impacts consumers’ disposable income.

The increase in sales of consumer electronics reflects increased consumer demand and our ability to improve

market share in this category in which the prices of products have increasingly become more commodity based.

For the fourth quarter of fiscal 2007, which includes the holiday selling season, domestic comparable store

sales declined 4.5% in the aggregate, with Sears Domestic and Kmart recording comparable store sales declines

of 4.0% and 5.2%, respectively. Fourth quarter comparable sales results largely reflect the same factors as noted

above. Declines for both the quarter and fiscal year include a more pronounced decline in comparable store sales

in the month of January 2008.

26