Sears 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

participants following retirement. The effect of this plan change, which was to reduce the projected benefit

obligation of the Sears domestic pension plan by approximately $80 million, has been recorded as a component

of purchase accounting.

In addition to providing pension benefits, Sears provides domestic and Canadian employees and retirees

certain medical benefits. These benefits provide access to medical plans, with Company subsidies for certain

eligible retirees. Certain domestic Sears’ retirees are also provided life insurance benefits. To the extent we share

the cost of the retiree medical benefits with retirees, such cost sharing is based on years of service and year of

retirement. Sears’ postretirement benefit plans are not funded. We have the right to modify or terminate these

plans.

Effective January 1, 2006, we eliminated our subsidization of retiree medical costs under the Sears’

domestic retiree medical plan for those Sears’ retirees who were under age 65 as of December 31, 2005. The

effect of this plan change, which was to reduce the projected benefit obligation associated with the plan by

approximately $174 million, has been recorded as a component of purchase accounting.

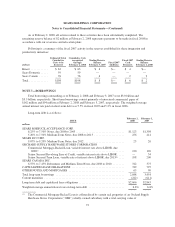

Changes in Accounting for Pensions and Postretirement Plans

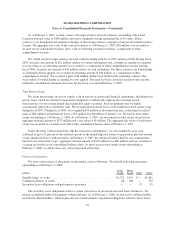

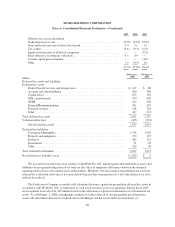

In September 2006, the FASB issued SFAS No. 158, which became effective for us as of February 3, 2007,

and requires recognition of an asset or liability in the statement of financial position reflecting the funded status

of pension and other postretirement benefit plans, with current-year changes in the funded status recognized in

shareholders’ equity. SFAS No. 158 did not change the existing criteria for measurement of periodic benefit

costs, plan assets or benefit obligations. The following table summarizes the incremental effects of the initial

adoption of SFAS No. 158 on the consolidated balance sheet at February 3, 2007.

millions

Before

Application of

SFAS 158

SFAS 158

Adjustments

After Application

of SFAS 158

Other assets ............................................. $ 447 $ (50) $ 397

Total assets ............................................. 29,956 (50) 29,906

Other current liabilities .................................... 3,852 43 3,895

Pension and postretirement benefits .......................... 1,620 27 1,647

Minority interest and other liabilities ......................... 2,993 (195) 2,798

Total liabilities .......................................... 17,325 (125) 17,200

Accumulated other comprehensive income (loss) ............... (16) 75 59

Total shareholders’ equity ................................. 12,631 75 12,706

Sears Canada Curtailment Gain

In February 2007, Sears Canada announced amendments to its post-retirement programs including the

introduction of a defined contribution component to its pension plan and the discontinuation of retiree medical,

dental and life benefits for those Sears Canada associates who will not have achieved eligibility for such benefits

by December 31, 2008. The amendments to the post-retirement programs generated a curtailment gain and

reduction to the benefit plan obligation in the amount of $27 million during the fiscal year ended February 2,

2008.

79