Sears 2007 Annual Report Download - page 30

Download and view the complete annual report

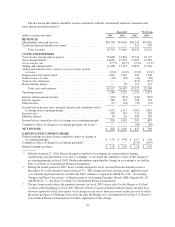

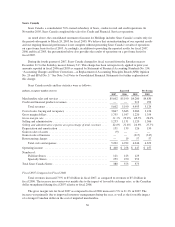

Please find page 30 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Domestic’s home services and Lands’ End businesses contributed to the overall improved gross margins for

Holdings during fiscal 2006. As was the case within other apparel businesses during fiscal 2006, the

improvement in Lands’ End’s gross margin reflected more extensive and effective use of direct-sourced

merchandise, as well as the favorable impact of pricing initiatives and stronger in-season sales results.

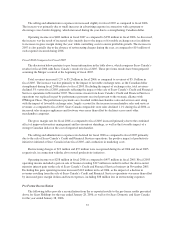

The selling and administrative expense rate was 21.8% in fiscal 2006, as compared to 22.0% (reported) and

22.4% (pro forma) for fiscal 2005. The fiscal 2006 improvement primarily reflects improved expense

management, with the most notable improvements made at Sears Canada due in part to the sale of Sears

Canada’s Credit and Financial Products business in late fiscal 2005.

Depreciation and amortization was $1.1 billion for fiscal 2006, as compared to $0.9 billion (reported) and

$1.1 billion (pro forma) for fiscal 2005. The increased expense for fiscal 2006, as compared to the reported

expense for fiscal 2005, was primarily attributable to the inclusion of Sears for the entire year in fiscal 2006.

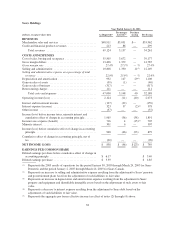

Gains on sales of assets were $82 million in fiscal 2006, as compared to $39 million (reported) and

$40 million (pro forma) for fiscal 2005. The increase in fiscal 2006 was primarily attributable to a $41 million

pre-tax gain recognized in 2006 in connection with the 2005 sale of our former Kmart headquarters in Troy,

Michigan.

Fiscal 2005 included a $317 million gain on sale of business, which reflected a minority interest gain on the

sale of Sears Canada’s Credit and Financial Services operations in November 2005. This gain had no impact on

Holdings’ net income as our entire impact was offset by increased minority interest expense. See Note 5 of Notes

to Consolidated Financial Statements for further detail.

Restructuring charges were $28 million and $111 million (reported and pro forma) for fiscal 2006 and fiscal

2005, respectively. These charges included charges of $19 million and $57 million in fiscal 2006 and fiscal 2005,

respectively, for employee-related termination costs associated with Sears Canada restructuring initiatives

implemented during fiscal 2005, including a workforce reduction of approximately 1,200 associates, as well as

$9 million and $54 million in fiscal 2006 and fiscal 2005, respectively, at Kmart for relocation assistance and

employee termination-related costs associated with Holdings’ home office integration efforts. See Note 6 of

Notes to Consolidated Financial Statements for further detail.

For fiscal 2006, interest and investment income was $253 million, as compared with $130 million (reported)

and $159 million (pro forma) in fiscal 2005. The increased interest and investment income in fiscal 2006 was

primarily due to total return swap income recognized during the year.

Other income is primarily comprised of bankruptcy-related recoveries. Bankruptcy-related recoveries

decreased $26 million in fiscal 2006 and represent amounts recovered from vendors who had received cash

payment for pre-petition obligations. See Note 13 of Notes to Consolidated Financial Statements for further

detail. The impact of lower bankruptcy-related recoveries in fiscal 2006 as compared with fiscal 2005 was

partially offset by increased income recorded relative to foreign currency forward contracts for which hedge

accounting was not applied. See Note 8 of Notes to Consolidated Financial Statements for further details.

The effective tax rate increased to 37.8% in fiscal 2006 from 36.4% in fiscal 2005, with the increase

primarily attributable to the fact that the effective rate in fiscal 2005 benefited from the November 2005 sale of

Sears Canada’s Credit and Financial Services business being taxed at a capital gains rate, lowering the effective

tax rate for fiscal 2005.

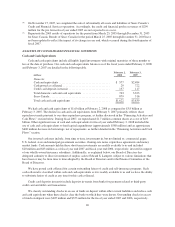

Effective January 27, 2005, we determined that it would be preferable to conform one of the accounting

practices utilized by Kmart to that of Sears. We changed our method of accounting for certain indirect overhead

costs from inventoriable costs to period expenses. In accordance with Accounting Principles Board Opinion

No. 20, “Accounting Changes,” a change in accounting policy to conform the acquirer’s policy to that of the

30