Sears 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

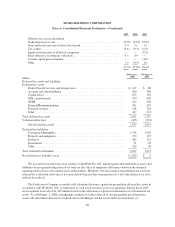

millions

2005

Kmart Sears

Sears

Holdings

Domestic Canada

Merchandise sales and services ............. $19,094 $25,868 $4,280 $49,242

Credit and financial products revenues ....... — — 213 213

Total revenues ...................... 19,094 25,868 4,493 49,455

Costs and expenses

Cost of sales, buying and occupancy .... 14,462 18,221 3,060 35,743

Selling and administrative ............. 3,804 5,968 1,120 10,892

Depreciation and amortization ......... 47 769 126 942

(Gain) loss on sales of assets ........... (40) 1 — (39)

Gain on sale of business .............. — — (317) (317)

Restructuring charges ................ 54 — 57 111

Total costs and expenses .......... 18,327 24,959 4,046 47,332

Operating income ....................... $ 767 $ 909 $ 447 $ 2,123

Total assets ............................ $ 7,325 $20,262 $2,880 $30,467

NOTE 20—LEGAL PROCEEDINGS

Pending against Sears and certain of its officers and directors are a number of lawsuits, described below,

that relate to Sears’ former credit card business and public statements about it. We believe that all of these claims

lack merit and, except as noted below, are defending against them vigorously.

•Marilyn Clark, derivatively on behalf of Sears, Roebuck and Co. v. Alan J. Lacy, et al.—On

October 23, 2002, a purported derivative suit was filed in the Supreme Court of the State of New York

(the “New York Court”) against Sears (as a nominal defendant) and certain current and former

directors seeking damages on behalf of Sears. The complaint purports to allege a breach of fiduciary

duty by the directors with respect to Sears’ management of its credit business. Two similar suits were

subsequently filed in the Circuit Court of Cook County, Illinois (the “Illinois State Court”), and a third

was filed in the United States District Court for the Northern District of Illinois. The New York Court

derivative suit was dismissed on June 21, 2004. A New York appellate court affirmed the dismissal on

December 6, 2005, and the time for further appeal has expired. The two Illinois State Court derivative

suits were dismissed on September 30, 2004. The order of dismissal became final on December 1,

2004, and the time to appeal has expired. The defendant directors filed a motion to dismiss the Illinois

federal court action on May 22, 2006. In lieu of a response, plaintiffs filed an amended complaint

seeking to correct various procedural deficiencies in their original pleading and adding Sears Holdings

Corporation as a defendant. Prior to the defendants responding to the amended complaint, the parties

had agreed to settle the matter. However, plaintiffs subsequently indicated that they were not

proceeding with the settlement and as a result, the defendants filed a motion to dismiss the amended

complaint. Briefing on the motion is scheduled to be completed by early April 2008. Meanwhile,

plaintiffs have filed a motion seeking a voluntary dismissal without prejudice.

•Thomas G. Ong for Thomas G. Ong IRA, et al. v. Sears, Roebuck & Co., et al.—On June 17, 2003, an

action was filed in the United States District Court for the Northern District of Illinois against Sears

and certain officers, purportedly on behalf of a class of all persons who, between June 21, 2002 and

October 17, 2002, purchased the 7% notes that SRAC issued on June 21, 2002. Pursuant to a

subsequently filed amended complaint, plaintiffs named as additional defendants certain former Sears

officers not originally named, SRAC and several investment banking firms, which had acted as

95