Sears 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

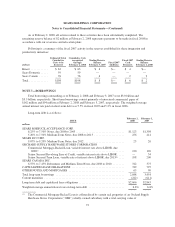

As of February 2, 2008, all actions related to these activities have been substantially completed. The

remaining reserve balance of $2 million at February 2, 2008 represents payments to be made in fiscal 2008 in

accordance with our severance and relocation plans.

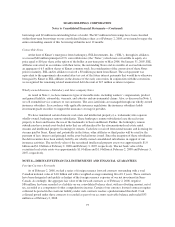

Following is a summary of the fiscal 2007 activity in the reserves established for these integration and

productivity initiatives:

millions

Estimated Total

Cumulative

Costs to be

Incurred

Cumulative Costs

recognized

through

February 2, 2008

Ending Reserve

Balance

February 3, 2007

Fiscal 2007

Additions

Fiscal 2007

Cash

Payments

Ending Reserve

Balance

February 2, 2008

Kmart ............ $ 63 $ 63 $ 4 $— $ 4 $—

Sears Domestic ..... 59 59 — — — —

Sears Canada ...... 76 76 4 — 2 2

Total ............. $198 $198 $ 8 $— $ 6 $ 2

NOTE 7—BORROWINGS

Total borrowings outstanding as of February 2, 2008 and February 3, 2007 were $3.0 billion and

$3.5 billion, respectively. Short-term borrowings consist primarily of unsecured commercial paper of

$162 million and $94 million at February 2, 2008 and February 3, 2007, respectively. The weighted-average

annual interest rate paid on short-term debt was 5.5% in fiscal 2007 and 5.2% in fiscal 2006.

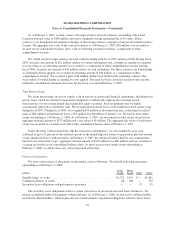

Long-term debt is as follows:

ISSUE

February 2,

2008

February 3,

2007

millions

SEARS ROEBUCK ACCEPTANCE CORP.

6.25% to 7.50% Notes, due 2008 to 2043.................................. $1,123 $1,398

5.20% to 7.50% Medium-Term Notes, due 2008 to 2013 ..................... 256 414

SEARS DC CORP.

9.07% to 9.20% Medium-Term Notes, due 2012 ............................ 25 26

ORCHARD SUPPLY HARDWARE STORES CORPORATION

Commercial Mortgage-Backed Loan, variable interest rate above LIBOR, due

2008(1) ........................................................... 120 120

Senior Secured Revolving Line of Credit, variable interest rate above LIBOR ..... — 34

Senior Secured Term Loan, variable rate of interest above LIBOR, due 2013(2) .... 198 200

SEARS CANADA INC.

6.55% to 7.45% Debentures and Medium-Term Notes, due 2008 to 2010 ........ 312 375

CAPITALIZED LEASE OBLIGATIONS ..................................... 749 797

OTHER NOTES AND MORTGAGES ....................................... 65 90

Total long-term borrowings ................................................ 2,848 3,454

Current maturities ........................................................ (242) (611)

Long-term debt and capitalized lease obligations ................................ $2,606 $2,843

Weighted-average annual interest rate on long-term debt ......................... 6.8% 6.8%

(1) The Commercial Mortgage-Backed Loan is collateralized by certain real properties of an Orchard Supply

Hardware Stores Corporation (“OSH”) wholly-owned subsidiary with a total carrying value of

72