Sears 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Claims Resolution

We have made significant progress in the reconciliation and settlement of various classes of claims

associated with the discharge of the Predecessor Company’s liabilities subject to compromise pursuant to the

Plan of Reorganization. Differences between claim amounts filed and our estimates are being investigated and

resolved through the claims resolution process. Since June 30, 2003, the first distribution date established in the

Plan of Reorganization, approximately 29.7 million shares of the 31.9 million shares set aside for distribution

have been distributed to holders of Class 5 claims, and approximately $9 million and $4 million in cash has been

distributed to the holders of Class 6 and to the holders of Class 7 claims, respectively. Further, we pro-rated

approximately $5 million from the settlement that the Creditor Trust received to holders of class 4, 5, 6, 8, 10 and

11 claims. Based on the Class 5 claims resolved and distributed to date, we believe that the ultimate amount of

allowed Class 5 claims will be less than the $4.3 billion provided for in the Plan of Reorganization. The

remaining shares left over after all Class 5 claims are ultimately settled will be distributed to the Class 5 creditors

in proportion to their allowed claims.

Bankruptcy-Related Settlements

In fiscal 2007, fiscal 2006, and fiscal 2005, we recognized recoveries of $18 million, $14 million, and

$40 million, respectively, from vendors who had received cash payments for pre-petition obligations (“critical

vendor claims”) or preference payments. In conjunction with these recoveries, we were assigned 205,317 shares

of common stock (weighted average price of $143.09 per share) with an approximate value of $29 million for

fiscal 2007.

NOTE 14—INCOME TAXES

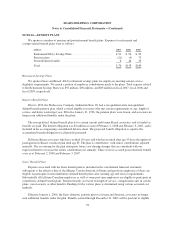

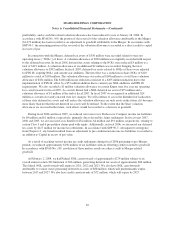

millions 2007 2006 2005

Income before income taxes

U.S. ...................................................... $ 953 $2,125 $1,467

Foreign ................................................... 499 346 495

Total ................................................. $1,452 $2,471 $1,962

Income tax expense

Current:

Federal ............................................... $ 76 $ 426 $ 251

State and local ......................................... 43 75 81

Foreign ............................................... 98 80 213

Total ..................................................... 217 581 545

Deferred:

Federal ............................................... 253 258 227

State and local ......................................... 2 44 19

Foreign ............................................... 78 50 (76)

333 352 170

Total ..................................................... $ 550 $ 933 $ 715

87