Sears 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

As of February 3, 2007, we had a series of foreign currency forward contracts outstanding with a total

Canadian notional value of $400 million and with a weighted-average remaining life of 0.4 years. These

contracts were designated and qualified as hedges of the foreign currency exposure of our net investment in Sears

Canada. The aggregate fair value of the forward contracts as of February 3, 2007, $26 million, was recorded as

an asset on our consolidated balance sheet, with an offsetting amount recorded as a component of other

comprehensive income.

We settled certain foreign currency forward contracts during both fiscal 2007 and fiscal 2006. During fiscal

2007, we paid a net amount of $12 million relative to contract settlements and, as hedge accounting was applied

to such contracts, an offsetting amount was recorded as a component of other comprehensive income. During

fiscal 2006, we paid a net amount of $42 million relative to such settlements. For those contracts for which hedge

accounting had been applied, we recorded an offsetting amount of $48 million as a component of other

comprehensive income. We recorded a gain of $6 million during fiscal 2006 for the remaining contracts that

were settled, for which hedge accounting was not applied. This gain has been classified as part of other income

within the consolidated statement of income for the fiscal year ended February 3, 2007.

Total Return Swaps

We, from time to time, invest our surplus cash in various securities and financial instruments, including total

return swaps, which are derivative instruments designed to synthetically replicate the economic return

characteristics of one or more underlying marketable equity securities. Such investments may be highly

concentrated and involve substantial risks. We recognized investment losses of $14 million on total return swaps

during fiscal 2007. During fiscal 2006, we recognized $74 million of investment income, consisting of realized

gains of $84 million and unrealized losses of $2 million less $8 million of interest cost. We had no total return

swaps outstanding as of February 2, 2008. As of February 3, 2007, our investments in total return swaps had an

aggregate notional amount of $375 million and a fair value of $5 million. The aggregate fair value of total return

swaps was recorded as a current receivable in the consolidated balance sheet at February 3, 2007.

Under the terms of the transactions with the respective counterparties, we were required to post cash

collateral of up to 25 percent of the notional amount of the underlying total return swap position, plus the amount

of any unrealized losses on the positions. At February 3, 2007, the collateral balance held by our counterparties

based on our total return swaps’ aggregate notional amount of $375 million was $80 million and was recorded as

a current receivable in our consolidated balance sheet. As there were no total return swaps outstanding at

February 2, 2008, we did not have any collateral posted at that date.

Financial Guarantees

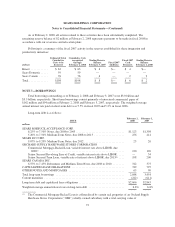

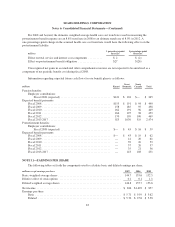

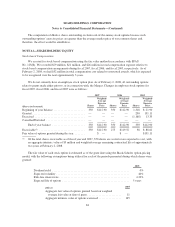

We issue various types of guarantees in the normal course of business. We had the following guarantees

outstanding as of February 2, 2008:

millions

Bank

Issued

SRAC

Issued Other Total

Standby letters of credit ............................................ $1,722 $119 $— $1,841

Commercial letters of credit ......................................... 66 104 — 170

Secondary lease obligations and performance guarantee ................... — — 55 55

The secondary lease obligations relate to certain store leases of previously divested Sears businesses. We

remain secondarily liable if the primary obligor defaults. As of February 2, 2008, we had an $11 million liability

recorded in other liabilities, which represents our current estimate of potential obligations related to these leases.

76