Sears 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

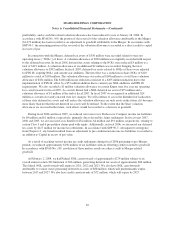

Effective May 11, 2005, Sears terminated for cause its Master Services Agreement (the “Agreement”) with

Computer Sciences Corporation (“CSC”). CSC had been providing information technology infrastructure support

services, including desktops, servers, and systems to support Sears-related websites, voice and data networks and

decision support technology to Sears and its subsidiaries under the 10-year Agreement entered into in June 2004.

CSC disputed Sears’ assertion that grounds for termination for cause existed and claimed that, as a result of

terminating the Agreement, Sears was liable to CSC for damages. On December 12, 2006, both Sears and CSC

filed separate Statements of Claim and Demands for Arbitration with the American Arbitration Association

seeking to resolve their dispute. Pursuant to an agreement dated October 22, 2007, the parties agreed to settle the

matter and on January 8, 2008, Sears made a net payment to CSC of $75 million in full and final satisfaction of

all amounts owed to CSC under the settlement agreement. In agreeing to the settlement, Sears did not admit any

wrongdoing. Sears agreed to the settlement solely to eliminate the uncertainties, burden and expense of further

protracted arbitration. Because we previously established a $54 million reserve for the expected settlement by

Sears, we recorded a $21 million charge in the third quarter of fiscal 2007 for the settlement on a pre-tax basis.

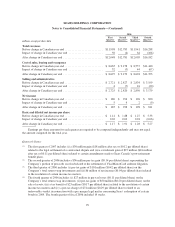

As previously reported in Kmart’s Annual Report on Form 10-K for its fiscal year ended January 26, 2005,

the staff of the Securities and Exchange Commission has been investigating, and the U.S. Attorney for the

Eastern District of Michigan has undertaken an inquiry into, the manner in which Kmart recorded vendor

allowances before a change in accounting principles at the end of fiscal 2001 and the disclosure of certain events

bearing on the Predecessor Company’s liquidity in the fall of 2001. Kmart has cooperated with the SEC and the

U.S. Attorney’s office with respect to these matters, which are ongoing.

On August 23, 2005, the SEC filed a complaint in the United States District Court for the Eastern District of

Michigan against the Predecessor Company’s former chief executive officer and its former chief financial officer

alleging that they misled investors about the Predecessor Company’s liquidity and related matters in the months

preceding its bankruptcy in violation of federal securities law. The complaint seeks permanent injunctions,

disgorgement with interest, civil penalties and officer and director bars. Kmart is not named as a defendant in the

action. In its press release announcing the filing of the complaint, the SEC stated that its Kmart investigation is

continuing.

In re: Sears Holdings Corporation Securities Litigation—In May and July 2006, two putative class action

lawsuits, which each name as defendants Sears Holdings Corporation and Edward S. Lampert, were filed in

United States District Court for the Southern District of New York, purportedly on behalf of a class of persons

that sold shares of Kmart Holding Corporation stock on or after May 6, 2003 through June 4, 2004. The plaintiffs

in each case allege that Kmart’s Plan of Reorganization and Disclosure Statement filed on January 24, 2003 and

amended on February 25, 2003 misrepresented Kmart’s assets, particularly its real estate holdings, as evidenced

by the prices at which Kmart subsequently sold certain of its stores in June 2004 to Home Depot and Sears. The

plaintiffs seek damages for alleged misrepresentations. On December 19, 2006, the Court consolidated the

actions. The plaintiffs have filed their consolidated complaint. The defendants have moved to dismiss the

consolidated complaint. Briefing on the motion is complete and the parties await a ruling from the Court.

AIG Annuity Insurance Company, et al. v. Sears, Roebuck and Co. —On October 12, 2004, an action was

filed against Sears in the District Court, 192nd Judicial District, Dallas County, Texas by several holders of

certain bonds issued by Sears from 1991 through 1993. Plaintiffs purport to allege under theories of breach of

contract and misrepresentation, that Sears prematurely redeemed the bonds in 2004 following Sears’ sale of the

credit business in 2003. On February 2, 2007, a jury in the case reached a verdict against Sears and the Court

subsequently awarded plaintiffs $61 million plus post-judgment interest. Sears has filed a notice of appeal and

briefing on the appeal is complete. The parties expect the Court to set the matter for oral argument soon.

97