Sears 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

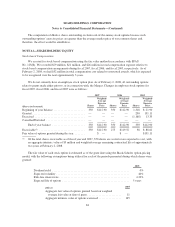

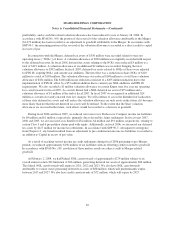

The plan’s target allocation is determined taking into consideration the amounts and timing of projected

liabilities, our funding policies and expected returns on various asset classes. At December 31, 2007, the plan’s

target asset allocation was 43% equity, 50% fixed income, and 7% other, which is comprised of alternative

investments that incorporate absolute return investment strategies. To develop the expected long-term rate of

return on assets assumption, we considered the historical returns and the future expectations for returns for each

asset class, as well as the target asset allocation of the pension portfolio.

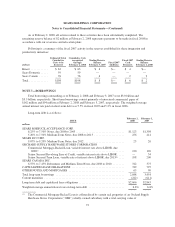

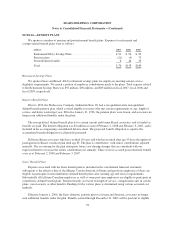

Postretirement Obligations

millions

2007 2006

Sears

Domestic

Sears

Canada Total

Sears

Domestic

Sears

Canada Total

Change in projected benefit obligation:

Beginning balance ........................... $367 $348 $715 $409 $349 $758

Benefits earned during the period ........... — 2 2 — 7 7

Interest cost ............................ 21 16 37 21 17 38

Plan participants’ contributions ............. 12 — 12 16 — 16

Actuarial gain ........................... (12) (15) (27) (8) (10) (18)

Benefits paid ........................... (54) (15) (69) (71) (14) (85)

Curtailment gain ......................... — (74) (74) — — —

Foreign currency exchange rate impact and

other ................................ — 46 46 — (1) (1)

Balance as of the measurement date ............. $334 $308 $642 $367 $348 $715

Change in plan assets at fair value:

Beginning of year balance ..................... $— $ 99 $ 99 $— $ 87 $ 87

Actual return on plan assets ................ — (2) (2) — 12 12

Company contributions ................... 42 15 57 55 15 70

Plan participants’ contributions ............. 12 — 12 16 — 16

Benefits paid ........................... (54) (15) (69) (71) (14) (85)

Foreign currency exchange rate impact and

other ................................ — 19 19 — (1) (1)

Balance as of the measurement date ............. $— $116 $116 $— $ 99 $ 99

Funded status ................................... $(334) $(192) $(526) $(367) $(249) $(616)

Employer contributions after measurement date and on or

before fiscal year end ........................... 4 — 4 3 — 3

Net amount recognized ........................... $(330) $(192) $(522) $(364) $(249) $(613)

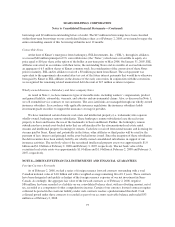

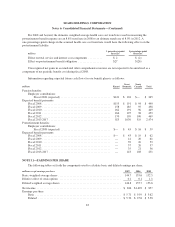

Weighted-average assumptions used to determine plan obligations are as follows:

2007 2006 2005

Kmart

Sears

Domestic

Sears

Canada Kmart

Sears

Domestic

Sears

Canada Kmart

Sears

Domestic

Sears

Canada

Pension benefits:

Discount Rate .................. 6.45% 6.45% 5.50% 5.90% 5.90% 5.25% 5.50% 5.50% 5.00%

Rate of compensation increases .... N/A N/A 4.00% N/A N/A 4.00% N/A N/A 4.00%

Postretirement benefits:

Discount Rate .................. N/A 6.45% 5.50% N/A 5.90% 5.25% N/A 5.50% 5.00%

Rate of compensation increases .... N/A N/A 4.00% N/A N/A 4.00% N/A N/A 4.00%

81