Sears 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

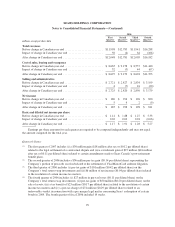

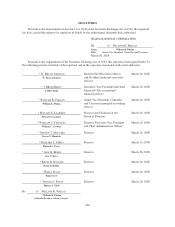

SEARS HOLDINGS CORPORATION

Schedule II—Valuation and Qualifying Accounts

Fiscal Years 2007, 2006 and 2005

millions

Balance at

beginning

of period

Additions

charged to

costs and

expenses

Additions

(deductions)

resulting from

the Merger

charged to

other accounts (Deductions)

Balance at

end of period

Allowance for Doubtful Accounts(1):

Fiscal 2007 ......................... $ 29 $11 $ — $ (3) $ 37

Fiscal 2006 ......................... 35 64 — (70) 29

Fiscal 2005 ......................... 40 71 16 (92) 35

Allowance for Deferred Tax Assets(2):

Fiscal 2007 ......................... 332 58 — (205) 185

Fiscal 2006 ......................... 330 2 — — 332

Fiscal 2005 ......................... 1,249 24 330 (200) 330

(1,073)

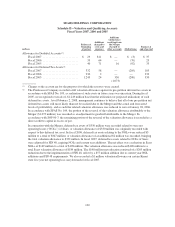

(1) Charges to the account are for the purposes for which the reserves were created.

(2) The Predecessor Company recorded a full valuation allowance against its pre-petition deferred tax assets in

accordance with SFAS No. 109, as realization of such assets in future years was uncertain. During fiscal

2005, we recognized reversals of, $1,249 million based on the utilization (or projected utilization) of such

deferred tax assets. As of February 2, 2008, management continues to believe that all of our pre-petition net

deferred tax assets will more likely than not be realized due to the Merger and the actual and forecasted

levels of profitability, and as such the related valuation allowance was reduced to zero at January 28, 2006.

In accordance with SFAS No. 109, the portion of the reversal of the valuation allowance attributable to the

Merger ($1,073 million) was recorded as an adjustment to goodwill attributable to the Merger. In

accordance with SOP 90-7, the remaining portion of the reversal of the valuation allowance is recorded as a

direct credit to capital in excess of par.

In connection with the Merger, deferred tax assets of $350 million were recorded related to state net

operating losses (“NOLs”) of Sears. A valuation allowance of $330 million was originally recorded with

respect to this deferred tax asset. In fiscal 2006, deferred tax assets relating to the NOLs were reduced $3

million to a total of $347 million. A valuation allowance of an additional $2 million was recorded, bringing

the total valuation allowance to $332 million. In fiscal 2007, deferred tax assets related to NOLs of Sears

were adjusted for FIN 48, expiring NOLs and current year additions. The net effect was a reduction in Sears

NOLs of $149 million to a total of $198 million. The valuation allowance was reduced $148 million to a

total Sears valuation allowance of $184 million. The $148 million net reduction consisted of a $205 million

reduction due to the implementation of FIN 48, offset by a $57 million addition due to current year NOL

additions and FIN 48 requirements. We also recorded a $1 million valuation allowance on certain Kmart

state five year net operating loss carryforwards for fiscal 2007.

100