Sears 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In fiscal 2005, the Finance Committee of our Board of Directors authorized the repurchase, subject to

market conditions and other factors, of up to $500 million of our outstanding indebtedness and our subsidiaries in

open market or privately negotiated transactions. The source of funds for the purchases is our cash from

operations or borrowings under the Credit Agreement. Our wholly-owned finance subsidiary, Sears Roebuck

Acceptance Corp. (“SRAC”), has repurchased $160 million of its outstanding notes, including $2 million

repurchased during each of fiscal 2007 and fiscal 2006, thereby reducing the unused balance of this authorization

to $340 million.

On January 31, 2005, Kmart entered into an agreement with Holdings and certain affiliates of

ESL Investments, Inc. (“ESL”). Pursuant to this agreement, ESL affiliates converted, in accordance with their

terms, all of the outstanding 9% convertible subordinated notes of Kmart and six months of accrued interest into

an aggregate of 6.3 million shares of Kmart common stock. In consideration of ESL’s conversion of the notes

prior to maturity, ESL received a $3 million payment from Kmart. The cash payment was equivalent to the

approximate discounted after-tax cost of the future interest payments that would have otherwise been paid by

Kmart to ESL and its affiliates in the absence of the early conversion. In conjunction with the conversion, we

recognized the remaining related unamortized debt discount of $17 million as interest expense.

During fiscal 2005, we terminated interest rate swaps with a notional value of approximately $1.0 billion

that had converted certain of our fixed-rate debt to floating-rate debt. We received $60 million in cash proceeds

from the swap terminations, representing the aggregate fair value of these swaps as of the termination date. As

the hedges related to these swaps qualified for hedge accounting, an offsetting adjustment was recorded to the

carrying amount of the designated hedged debt, which remains outstanding, and this adjustment will be

amortized into interest expense over the remaining term of the debt. We had no interest rate swaps outstanding at

February 2, 2008.

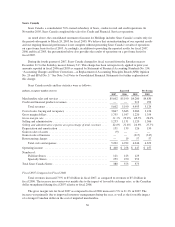

Debt Ratings

The ratings of our domestic debt securities as of February 2, 2008 appear in the table below:

Moody’s

Investors

Service

Standard &

Poor’s

Ratings

Services

Fitch

Ratings

Unsecured long-term debt ........................ Ba2 BB BB

Unsecured commercial paper ...................... NP B-2 B

Credit Agreement

We have a $4.0 billion, five-year credit agreement (the “Credit Agreement”) in place as a funding source for

general corporate purposes, which includes a $1.5 billion letter of credit sublimit. The Credit Agreement, which has

an expiration date of March 2010, is a revolving credit facility under which SRAC and Kmart Corporation are the

borrowers. The Credit Agreement is guaranteed by Holdings and certain of our direct and indirect subsidiaries and

is secured by a first lien on our domestic inventory, credit card accounts receivable and the proceeds thereof.

Availability under the Credit Agreement is determined pursuant to a borrowing base formula, based on domestic

inventory levels, subject to certain limitations. As of February 2, 2008, we had $974 million of letters of credit

outstanding under the Credit Agreement with $3.0 billion of availability remaining under the Credit Agreement.

During fiscal 2007, maximum direct borrowings outstanding under the Credit Agreement were $675 million, which

were repaid before the fiscal year end. The Credit Agreement does not contain provisions that would restrict

borrowings or letter of credit issuances based on material adverse changes or credit ratings.

Letter of Credit Agreement

We also have a letter of credit agreement (the “LC Agreement”) with a commitment amount of up to

$1.0 billion. The LC Agreement, which is renewable annually upon agreement of the parties, is next up for

44