Redbox 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

incentives granted in the form of stock options, restricted stock and performance-based restricted stock, which we

consider to be at-risk compensation. The Committee believes that a percentage of total compensation should be at-

risk in terms of option price and Company performance. Based on this philosophy, the Committee began granting

performance-based restricted stock in 2007.

Annual Long-Term Incentives

For 2008, the Committee delivered the same annual long-term incentive compensation value to Named

Executive Officers as it did for 2007, comprised of 60% stock options, 20% restricted stock and 20% performance-

based restricted stock, based on an evaluation of the following factors:

• the anticipated contribution by the executive officer;

• the equity awards required from a competitive point of view to retain the services of a valued executive

officer;

• market data for comparable positions at our peer group companies;

• the number of stock options or restricted stock awards currently held by the executive officer; and

• the value of long-term incentives as a percentage of total compensation.

The Committee did not assign a relative weight to any one particular factor. Based on the Committee’s

evaluation of these factors, the Committee believes the grants of stock options, restricted stock and performance-

based restricted stock were merited.

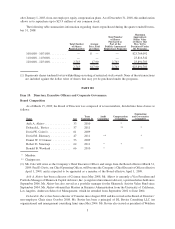

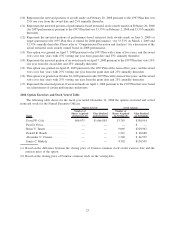

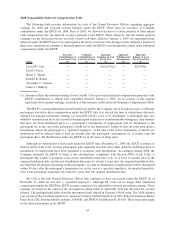

In February 2008, our then existing Named Executive Officers received the following stock options and

restricted stock awards:

Named Executive Officer

Restricted

Stock

Stock

Options

David W. Cole................................................. 7,889 78,334

Brian V. Turner ................................................ 4,180 41,506

Donald R. Rench . . . ............................................ 1,361 13,516

Alexander C. Camara............................................ 1,972 19,578

James C. Blakely . . . ............................................ 1,972 19,578

In April 2008, in connection with his hire, the Committee granted Mr. Davis a stock option to purchase

100,000 shares of Coinstar common stock and a restricted stock award for 10,000 shares of Coinstar common stock.

The Committee reviewed market data from Towers Perrin for Chief Operation Officer positions at similarly situated

companies in determining the size of these initial awards.

All restricted stock awards granted to the Named Executive Officers in 2008 vest (and are no longer subject to

forfeiture) in equal annual installments over the period from the date of award until the fourth anniversary of the

date of award. All stock options granted to the Named Executive Officers in 2008 have a term of five years and vest

and become exercisable in equal annual installments over the period from the date of award until the fourth

anniversary of the date of award. The exercise price for all option grants is set at the closing price on the date on

which the option grant is made.

Although we do not have nor do we intend to have a program, plan or practice to time stock option grants to our

existing executives or to new executives in coordination with the release of material nonpublic information for the

purpose of affecting the value of executive compensation, rather than approving grants of stock options and

restricted stock awards to our executives in late January 2008 as originally scheduled, the Committee delayed

approval of stock option and restricted stock awards until its meeting in February 2008, after announcement of an

agreement to expand Coinstar Centers and Redbox DVD rental kiosks in Wal-Mart stores, because the Committee

believed that this approach would be more fair to stockholders.

Executive officers received performance-based restricted stock awards in June 2008 for 2008 compensation.

Similar to the performance-based restricted stock awards granted for 2007, the Committee decided to use EBITDA

as the performance measure for the 2008 awards. The Committee chose EBITDA because of its importance as a

14