Redbox 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If any related person transaction is not approved or ratified, the Committee may take such action as it may

deem necessary or desirable in the best interests of the Company and its stockholders.

The Shamrock Agreement (as defined below) was considered and approved by the full Board.

Related Person Transactions

Pursuant to an agreement (the “Shamrock Agreement”) dated May 28, 2008, by and among Coinstar, Inc.,

Shamrock Activist Value Fund, L.P., Shamrock Activist Value Fund II, L.P., Shamrock Activist Value Fund III, L.P.,

Shamrock Activist Value Fund GP, L.L.C., and Shamrock Partners Activist Value Fund, L.L.C. (collectively, the

“Shamrock Group”), Coinstar increased the size of its board of directors by one member to eight members, and, to

fill that vacancy, appointed Arik A. Ahitov, a director nominated by the Shamrock Group, and agreed to generally

support the nomination of Mr. Ahitov through the end of our 2010 Annual Meeting of Stockholders. The Shamrock

Group collectively beneficially owns greater than 5% of Coinstar. If the Shamrock Group’s holdings of Coinstar

common stock become 1,856,377 or fewer shares, then pursuant to the Shamrock Agreement, the Shamrock Group

will use good faith efforts to cause its nominated director to resign from the board of directors. In addition to the

appointment of the director nominated by the Shamrock Group, Coinstar agreed to increase the size of its board of

directors to nine directors and fill that vacancy with an independent director no later than March 1, 2009, whose

term will expire at the 2009 Annual Meeting. Coinstar increased the size of the Board and, on February 27, 2009,

appointed Daniel W. O’Connor to fill that vacancy. In addition, as part of the Shamrock Agreement, the Shamrock

Group made certain covenants regarding proxy solicitation and voting through the end of the 2010 Annual Meeting.

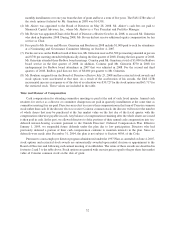

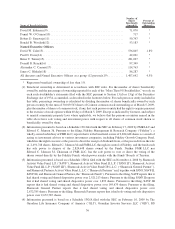

Mr. Ahitov receives the standard compensation received by Coinstar non-employee directors. The components

of Coinstar’s standard non-employee director cash and equity compensation are described above under “2008 Direc-

tor Compensation.” Mr. Ahitov’s cash fees are paid to Shamrock Capital Advisors, Inc., where Mr. Ahitov is a Vice

President and Portfolio Manager. In addition, pursuant to the Shamrock Agreement, Coinstar reimbursed the

Shamrock Group $350,000 for its out-of-pocket expenses relating to its director nominations made pursuant to its

2008 proxy statement filings and entering into the Shamrock Agreement.

Director Independence

The Nasdaq Marketplace Rules require that a majority of our directors be “independent,” as defined by Nasdaq

Marketplace Rule 4200(a)(15). The Board of Directors, following the review and recommendation of the

Nominating and Governance Committee, reviewed the independence of our directors, including whether specified

transactions or relationships exist currently, or existed during the past three years, between our directors, or certain

family members or affiliates of our directors, and Coinstar and our subsidiaries, certain other affiliates, or our

independent registered public accounting firm. In the review, the placement of Coinstar products and services in

West Coast Bank locations, which are owned and operated by West Coast Bancorp, of which Mr. Sznewajs is the

president, chief executive officer, and a member of the board of directors, was considered. In addition, the

independence of a director who was an officer of a company whose parent company has an investment in a company

that has a business relationship with Coinstar, was considered. Further, Mr. Ahitov’s affiliations with Shamrock

funds and their affiliates, collectively a greater than 5% beneficial owner of Coinstar, were considered. As a result of

the review, the Board determined that all of the directors, including Mr. Grinstein and Mr. Rouleau during their

service on the Board, and except for Mr. Cole, who is an employee, were “independent” under the applicable

Nasdaq Marketplace Rules described above. All of the members of each of the Audit, Compensation, and

Nominating and Governance committees, including Mr. Grinstein and Mr. Rouleau, met the criteria for indepen-

dence prescribed by Nasdaq.

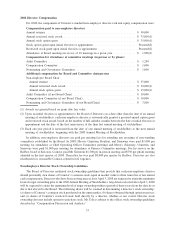

Item 14. Principal Accounting Fees and Services.

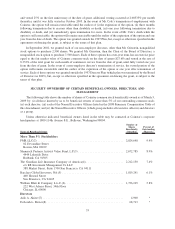

Fees Paid to Independent Registered Public Accounting Firm

In connection with the audit of the 2008 financial statements and internal control over financial reporting, we

entered into an engagement letter with KPMG LLP that sets forth the terms by which KPMG LLP will perform audit

services for Coinstar. That agreement is subject to alternative dispute resolution procedures, an exclusion of

punitive damages, and various other provisions.

39