Redbox 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

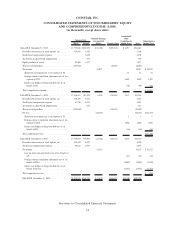

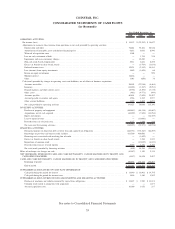

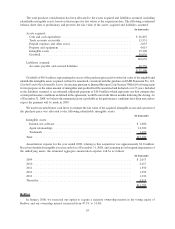

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except share data)

Shares Amount

Retained Earnings

(Accumulated

Deficit) Treasury Stock

Accumulated

Other

Comprehensive

Income (Loss) Total

Comprehensive

Income (Loss)

Common Stock

BALANCE, December 31, 2005 . . .............. 27,775,628 $328,951 $(13,158) $(22,783) $ 1,037 $294,047

Proceeds from exercise of stock options, net . . ..... 310,840 5,368 5,368

Stock-based compensation expense . . . .......... 6,258 6,258

Tax benefit on share-based compensation ......... 979 979

Equity purchase of assets ................... 63,468 1,673 1,673

Treasury stock purchase ................... (333,925) (8,023) (8,023)

Net income . . . ........................ 18,627 18,627 $ 18,627

Short-term investments net of tax expense of $8 . . . 12 12 12

Foreign currency translation adjustments net of tax

expense of $732 . . ................... 2,482 2,482 2,482

Interest rate hedges on long-term debt net of tax

benefit of $34 . . . ................... (58) (58) (58)

Total comprehensive income . . . .............. $ 21,063

BALANCE, December 31, 2006 . . .............. 27,816,011 343,229 5,469 (30,806) 3,473 321,365

Proceeds from exercise of stock options, net . . ..... 218,229 4,232 4,232

Stock-based compensation expense . . . .......... 63,746 6,421 6,421

Tax benefit on share-based compensation ......... 627 627

Treasury stock purchase ................... (358,942) (10,025) (10,025)

Net loss ............................. (22,253) (22,253) $(22,253)

Short-term investments net of tax expense of $2 . . . 1 1 1

Foreign currency translation adjustments net of tax

expense of $205 . . ................... 4,828 4,828 4,828

Interest rate hedges on long-term debt net of tax

benefit of $44 . . . ................... (66) (66) (66)

Total comprehensive loss ................... $(17,490)

BALANCE, December 31, 2007 . . .............. 27,739,044 354,509 (16,784) (40,831) 8,236 305,130

Proceeds from exercise of stock options, net . . ..... 425,410 8,629 8,629

Stock-based compensation expense . . . .......... 90,616 6,597 6,597

Net income . . . ........................ 14,112 14,112 $ 14,112

Loss on short-term investments net of tax benefit of

$27............................. (41) (41) (41)

Foreign currency translation adjustments net of tax

benefit of $544 . . . ................... (9,845) (9,845) (9,845)

Interest rate hedges on long-term debt net of tax

benefit of $2,912 . . ................... (4,554) (4,554) (4,554)

Total comprehensive loss ................... $ (328)

BALANCE, December 31, 2008 .............. 28,255,070 $369,735 $ (2,672) $(40,831) $(6,204) $320,028

See notes to Consolidated Financial Statements

54