Redbox 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

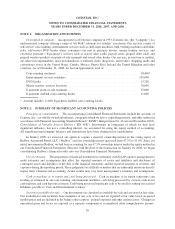

and related hedged items affect a company’s financial position, financial performance and cash flows. The

provisions of SFAS 161 are effective for financial statements issued for fiscal years and interim periods beginning

after November 15, 2008. SFAS 161 requires us to expand certain disclosures. We do not anticipate that the adoption

of SFAS 161 will have a material impact on our consolidated financial position, results of operations or cash flows.

Reclassifications: Certain reclassifications have been made to the prior year amounts to conform to the

current year presentation.

NOTE 3: ACQUISITIONS

In connection with our acquisitions, we have allocated the respective purchase prices plus transaction costs to

the estimated fair values of the tangible and intangible assets acquired and liabilities assumed. These purchase price

allocation estimates were based on our estimates of fair values.

Coinstar Money Transfer

During the second quarter of 2006, we acquired Coinstar Money Transfer (“CMT”) for $27.5 million in cash.

The acquisition was effected pursuant to the Agreement for the Sale and Purchase of the Entire Issued Share Capital

of Travelex Money Transfer Limited dated April 30, 2006, between Travelex Limited, Travelex Group Limited, and

Coinstar. CMT is one of the leading money transfer networks in terms of agent locations and countries in which we

do business. In addition to company-owned locations, CMT has agreements with banks, post offices, and other retail

locations to offer its service. CMT was established in mid-2003 and uses leading edge Internet-based technology to

provide consumers with an easy-to-use, reliable and cost-effective way to send money around the world. In addition

to the purchase price, we incurred $2.1 million in transaction costs, including costs relating to legal, accounting and

other directly related charges. The results of operations of CMT since May 31, 2006, are included in our

Consolidated Financial Statements. Of the total purchase price, approximately $23.9 million was allocated to

goodwill, which will not be amortized, and $8.9 million was allocated to intangible assets which will be amortized

over various terms through 2016.

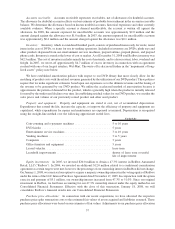

GroupEx

On January 1, 2008, we acquired GroupEx Financial Corporation, JRJ Express Inc. and Kimeco, LLC

(collectively, “GroupEx”), for an aggregate purchase price of $70.0 million. The purchase price included a

$60.0 million cash payment at closing. In addition, there is an additional payment of up to $10.0 million should

certain performance conditions be met in the fifteen months following the closing. As of December 31, 2008, we

believe this payout is probable as the performance conditions have been met. Further, we incurred an estimated

$2.1 million in transaction costs, including legal, accounting, and other directly related charges. The total purchase

price, net of cash acquired, was $45.3 million. The results of operations of GroupEx from January 1, 2008 are

included in our Consolidated Financial Statements.

The acquisition was recorded under the purchase method of accounting and the purchase price was allocated

based on the fair value of the assets acquired and the liabilities assumed.

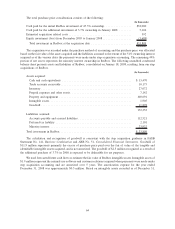

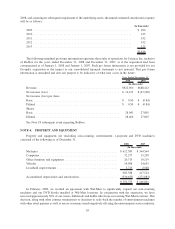

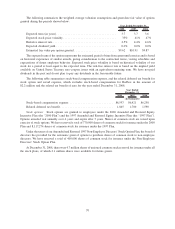

The total purchase price consideration consists of the following:

(In thousands )

Cash paid for acquisition of GroupEx . . . ................................. $60,000

Additional payout ................................................... 10,000

Acquisition related costs .............................................. 2,100

$72,100

62