Redbox 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

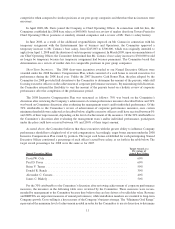

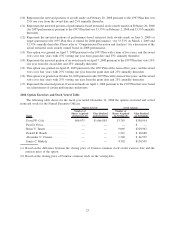

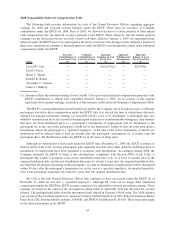

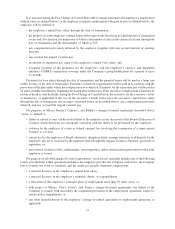

2008 Grants of Plan-Based Awards Table

The following table shows equity awards granted to our Named Executive Officers under the 1997 Amended

and Restated Equity Incentive Plan, as amended (the “1997 Plan”), for the fiscal year ended December 31, 2008.

Name

Grant

Date

Threshold

(#)

Target

(#)

Maximum

(#)

All Other

Stock

Awards:

Number of

Shares of

Stock or

Units

(#)(1)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

Exercise

or Base

Price of

Option

Awards

($ / Sh)

Grant Date

Fair Value

of Stock

and Option

Awards

($)

Estimated Future Payouts

Under

Equity Incentive Plan Awards

David W. Cole . . . . . . . . . . . . — 3,309 6,619 9,928

2/20/08 $447,584

2/20/08 14,306 78,334 $31.94 739,473

Paul D. Davis . . . . . . . . . . . . . — 2,627 5,253 7,880

4/7/08 $308,200

4/7/08 10,000 100,000 $30.82 937,000

Brian V. Turner . . . . . . . . . . . . — 1,753 3,507 5,260

2/20/08 $231,298

2/20/08 7,388 41,506 $31.94 391,817

Donald R. Rench . . . . . . . . . . — 571 1,142 1,713

2/20/08 $ 74,777

2/20/08 2,388 13,516 $31.94 127,591

Alexander C. Camara . . . . . . . — 827 1,654 2,481

2/20/08 $102,095

2/20/08 3,255 19,578 $31.94 184,816

James C. Blakely . . . . . . . . . . — 827 1,654 2,481

2/20/08 3,255 $102,095

2/20/08 19,578 $31.94 184,816

4/1/08 4,000 114,000

(1) Includes performance-based restricted stock earned for 2007 performance as follows: Mr. Cole, 6,417 shares;

Mr. Turner, 3,208 shares; Mr. Rench, 1,027 shares; Mr. Camara, 1,283 shares; and Mr. Blakely, 1,283 shares.

Employment Agreements

David W. Cole, Chief Executive Officer. In January 2004, the Company entered into an employment

agreement with our Chief Executive Officer, David W. Cole. The agreement superseded all prior employment

agreements between Mr. Cole and the Company. Under the terms of the employment agreement, the Company

agreed to pay Mr. Cole an initial annual base salary of $346,700, subject to possible increase at the discretion of the

Compensation Committee. Mr. Cole is also eligible to receive annual cash awards (under the non-equity incentive

plan) based on the achievement of certain performance targets applicable to the award. For a description of the

severance provisions in Mr. Cole’s employment agreement, please refer to the section entitled “Elements of Post-

Termination Compensation and Benefits.”

Paul D. Davis, Chief Operating Officer. In April 2008, the Company entered into an employment agreement

with our Chief Operating Officer, Paul D. Davis. Under the terms of the employment agreement, the Company

agreed to pay Mr. Davis an initial annual base salary of $400,000, subject to possible increase at the discretion of the

Compensation Committee. Mr. Davis is also eligible to receive annual cash awards (under the non-equity incentive

plan) based on the achievement of certain performance targets applicable to the award. In addition, Mr. Davis

received a stock option grant to purchase 100,000 shares of the Company’s common stock, with an exercise price

equal to the closing price of the Company’s common stock on April 7, 2008 and a four-year vesting period, and a

grant of 10,000 shares of restricted stock, with a four-year vesting period. For a description of the severance

provisions in Mr. Davis’s employment agreement, please refer to the section below entitled “Elements of Post-

Termination Compensation and Benefits.”

19