Redbox 2008 Annual Report Download - page 62

Download and view the complete annual report

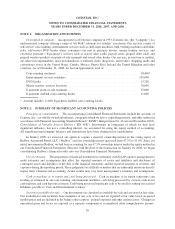

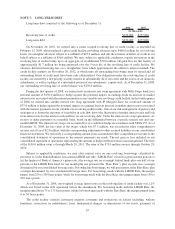

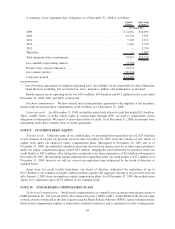

Please find page 62 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.notional amount of $75.0 million to hedge against the potential impact on earnings from an increase in market

interest rates associated with the interest payments on our variable-rate revolving credit facility. One of our risk

management objectives and strategies is to lessen the exposure of variability in cash flow due to the fluctuation of

market interest rates and lock in an interest rate for the interest cash outflows on our revolving debt. Under the

interest rate swap agreements, we receive or make payments on a monthly basis, based on the differential between a

specific interest rate and one-month LIBOR. The interest rate swaps are accounted for as cash flow hedges in

accordance with FASB Statement No. 133, Accounting for Derivative Instruments and Hedging Activities

(“SFAS 133”). As of December 31, 2008, the fair value of the swaps, which was $7.5 million, was recorded in

other comprehensive income, net of tax of $2.9 million, with the corresponding adjustment to other accrued

liabilities in our consolidated financial statements. We reclassify a corresponding amount from accumulated other

comprehensive income to the consolidated statement of operations as the interest payments are made. The net gain

or loss included in our consolidated statement of operations representing the amount of hedge ineffectiveness is

inconsequential. The term of the $150.0 million swap is through March 20, 2011. The term of the $75.0 million

swap is through October 28, 2010.

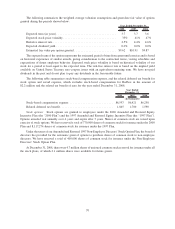

Stock-based compensation: Effective January 1, 2006, we adopted the fair value recognition provisions of

FASB Statement No. 123 (revised 2004), Share-Based Payment (“SFAS 123R”) using the modified — prospective

transition method. Under this transition method, compensation expense recognized includes the estimated fair value

of stock options granted on and subsequent to January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS 123R, and the estimated fair value of the portion vesting in the period for

options granted prior to, but not vested as of January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of FASB Statement No. 123, Accounting for Stock-Based Compensation.

Prior to the adoption of SFAS 123R we presented all tax benefits resulting from the exercise of stock options as

operating cash inflows in the consolidated statements of cash flows, in accordance with the provisions of the

Emerging Issues Task Force (“EITF”) Issue No. 00-15, Classification in the Statement of Cash Flows of the Income

Tax Benefit Received by a Company upon Exercise of a Nonqualified Employee Stock Option. SFAS 123R requires

the benefits of tax deductions in excess of the compensation cost recognized for those options to be classified as

financing cash inflows when they are realized rather than operating cash inflows, on a prospective basis. Excess tax

benefits were approximately zero for the year ended 2008. Excess tax benefits generated during the years ended

December 31, 2007 and 2006 were approximately $3.8 million and $1.0 million, respectively.

Income taxes: Deferred income taxes are provided for the temporary differences between the financial

reporting basis and the tax basis of our assets and liabilities and operating loss and tax credit carryforwards. A

valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be

realized. Deferred tax assets and liabilities and operating loss and tax credit carryforwards are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences and

operating loss and tax credit carryforwards are expected to be recovered or settled.

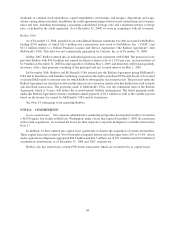

Effective January 1, 2007, we adopted the provisions of FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes (“FIN 48”). FIN 48 is an interpretation of FASB Statement No. 109, Accounting

for Income Taxes (“SFAS 109”) which provides comprehensive guidance on the recognition and measurement of

tax positions in previously filed tax returns or positions expected to be taken in future tax returns. The tax benefit

from an uncertain tax position must meet a “more-likely-than-not” recognition threshold and is measured at the

largest amount of benefit greater than 50% determined by cumulative probability of being realized upon ultimate

settlement with the taxing authority. The interpretation provides guidance on derecognition, classification, interest

and penalties, as well as disclosure requirements in the financial statements of uncertain tax positions.

As of the adoption date and as of December 31, 2008 and 2007, we identified $1.2 million of unrecognized tax

benefits which would affect our effective tax rate if recognized.

In accordance with our accounting policy, we recognize interest and penalties associated with uncertain tax

positions in income tax expense. As of the adoption date and December 31, 2008 and 2007, it was not necessary to

accrue interest and penalties associated with the uncertain tax positions identified because operating losses and tax

credit carryforwards are sufficient to offset all unrecognized tax benefits.

60