Redbox 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

settlement with the taxing authority. The interpretation provides guidance on derecognition, classification, interest

and penalties, as well as disclosure requirements in the financial statements of uncertain tax positions.

As of the adoption date and as of December 31, 2008, we identified $1.2 million of unrecognized tax benefits

which would affect our effective tax rate if recognized.

In accordance with our accounting policy, we recognize interest and penalties associated with uncertain tax

positions in income tax expense. As of the adoption date and as of December 31, 2008, it was not necessary to

accrue interest and penalties associated with the uncertain tax positions identified because operating losses and tax

credit carryforwards were sufficient to offset all unrecognized tax benefits.

Cash in machine or in transit and cash being processed: Cash in machine or in transit represents coin residing

or estimated in our coin-counting or entertainment machines, cash being processed by carriers, cash in our cash

registers and cash deposits in transit. Cash being processed represents cash which we are obligated to use to settle

our accrued liabilities payable to retailers.

Stock-based compensation: Effective January 1, 2006, we adopted the fair value recognition provisions of

FASB Statement No. 123 (revised 2004), Share-Based Payment (“SFAS 123R”) using the modified — prospective

transition method. Under this transition method, compensation expense recognized includes the estimated fair value

of stock options granted on and subsequent to January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS 123R, and the estimated fair value of the portion vesting in the period for

options granted prior to, but not vested as of January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of FASB Statement No. 123, Accounting for Stock-Based Compensation.In

accordance with the modified-prospective transition method, results for prior periods have not been restated.

Recent Accounting Pronouncements

In September 2006, the FASB issued FASB Statement No. 157, Fair Value Measures (“SFAS 157”), which

defines fair value, establishes a framework for measuring fair value and enhances disclosures about fair value

measures. Effective January 1, 2008, we implemented SFAS 157 for our financial assets and liabilities. In

accordance with the provisions of FSP No. FAS 157-2, Effective Date of FASB Statement No. 157, we elected to

defer implementation of SFAS 157 related to our non-financial assets and non-financial liabilities that are

recognized and disclosed at fair value in the financial statements on a nonrecurring basis until January 1,

2009. The adoption of SFAS 157 related to our non-financial assets and non-financial liabilities will not have

a significant impact on our consolidated financial position, results of operations or cash flows.

The adoption of SFAS 157 with respect to financial assets and liabilities did not have a material impact on our

financial results for the year ended December 31, 2008. SFAS 157 establishes a hierarchy that prioritizes fair value

measurements based on the types of inputs used for the various valuation techniques. The levels of the hierarchy are

described below:

•Level 1: Observable inputs such as quoted prices in active markets for identical assets or liabilities

•Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or

indirectly; these include quoted prices for similar assets or liabilities in active markets and quoted prices for

identical or similar assets or liabilities in markets that are not active

•Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions

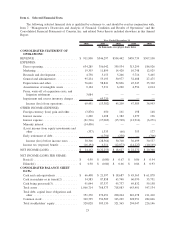

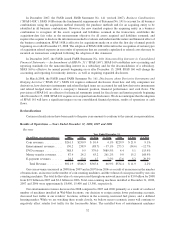

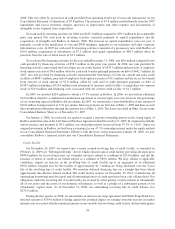

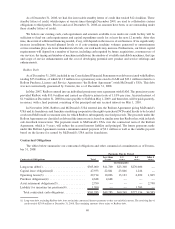

We use a market approach valuation technique in accordance with SFAS 157 and we measure fair value based

on quoted prices observed from the marketplace. The following table presents our financial assets that have been

measured at fair value as of December 31, 2008 and indicates the fair value hierarchy of the valuation inputs utilized

to determine such fair value.

Level 1 Level 2 Level 3

Balance as of

December 31, 2008

Short-term investment ...................................... $822 — —

Interest rate swap liability ................................... — $7,466 —

31