Redbox 2008 Annual Report Download - page 119

Download and view the complete annual report

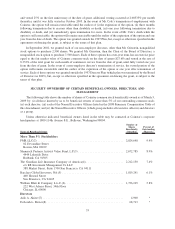

Please find page 119 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investment Management Co. LLC (“RS Investment Management”), and RS Partners Fund. Pursuant to the

filing, GLI, GIS, and RS Investment Management report that they had shared voting and shared dispositive

power over 2,212,130 shares. Pursuant to the filing, RS Partners Fund reports that it had shared voting and

shared dispositive power over 1,444,434 shares.

(5) Information presented is based on a Schedule 13G filed with the SEC on February 5, 2009 by Barclays Global

Investors, NA. (“BGI”), Barclays Global Fund Advisors (“BGF”), Barclays Global Investors, LTD (“Barclays

Investors”), Barclays Global Investors Japan Limited (“Barclays Japan Limited”), Barclays Global Investors

Canada Limited (“Barclays Canada Limited”), Barclays Global Investors Australia Limited (“Barclays

Australia Limited”), and Barclays Global Investors (Deutschland) AG (“Barclays Deutschland”). Pursuant to

the filing, BGI reports that it had sole voting power over 558,506 shares and sole dispositive power over

661,595 shares. Pursuant to the filing, BGF reports that it had sole voting power over 817,503 shares and sole

dispositive power over 1,139,065 shares. Pursuant to the filing, Barclays Investors reports that it had sole

voting power over 600 shares and sole dispositive power over 18,581 shares. Pursuant to the filing, Barclays

Japan Limited, Barclays Canada Limited, Barclays Australia Limited, and Barclays Deutschland report that

they had no voting power or dispositive power over shares.

(6) Information presented is based on a Schedule 13G/A filed with the SEC on January 12, 2009 by

William Blair & Company, L.L.C. (“William Blair”). Pursuant to the filing, William Blair reports that it

had sole voting and dispositive power over all reported shares.

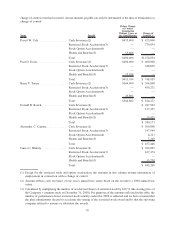

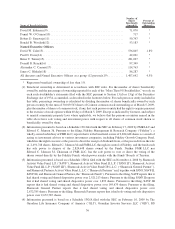

(7) The number of shares beneficially owned by Mr. Ahitov includes (a) 2,867 shares issuable upon the exercise of

options exercisable within 60 days of March 5, 2009 and (b) 2,033 shares of unvested restricted stock.

Mr. Ahitov disclaims beneficial ownership over any shares owned by the Shamrock Funds even though

Mr. Ahitov is the Vice President and Portfolio Manager of Shamrock Capital Advisors, Inc. (an affiliate of

SAVF) and also a senior portfolio manager for SAVF, SAVF II, and SAVF III.

(8) The number of shares beneficially owned by Ms. Bevier includes (a) 55,301 shares issuable upon the exercise

of options exercisable within 60 days of March 5, 2009 and (b) 2,033 shares of unvested restricted stock.

(9) The number of shares beneficially owned by Mr. Eskenazy includes (a) 60,801 shares issuable upon the

exercise of options exercisable within 60 days of March 5, 2009, (b) 2,033 shares of unvested restricted stock,

and (c) 8,236 shares held in a margin account.

(10) All shares beneficially owned by Mr. O’Connor are unvested restricted stock.

(11) The number of shares beneficially owned by Mr. Sznewajs includes (a) 5,566 shares credited to Mr. Sznewajs’s

deferred account under the Outside Directors’ Deferred Compensation Plan, (b) 39,301 shares issuable upon

the exercise of options exercisable within 60 days of March 5, 2009, and (c) 2,033 shares of unvested restricted

stock.

(12) The number of shares beneficially owned by Mr. Woodard includes (a) 44,301 shares issuable upon the

exercise of options exercisable within 60 days of March 5, 2009 and (b) 2,033 shares of unvested restricted

stock.

(13) The number of shares beneficially owned by Mr. Cole includes (a) 444,209 shares issuable upon the exercise

of options exercisable within 60 days of March 5, 2009, (b) 23,925 shares of unvested restricted stock, and

(c) 23,178 shares held in trust under the Cole Living Trust, dated August 5, 2003, and any amendments thereto,

for the benefit of Mr. Cole and his spouse, with Mr. Cole and his spouse as trustees.

(14) The number of shares beneficially owned by Mr. Davis includes (a) 25,000 shares issuable upon the exercise of

options exercisable within 60 days of March 5, 2009 and (b) 15,253 shares of unvested restricted stock.

(15) The number of shares beneficially owned by Mr. Turner includes (a) 237,926 shares issuable upon the exercise

of options exercisable within 60 days of March 5, 2009 and (b) 13,711 shares of unvested restricted stock.

(16) The number of shares beneficially owned by Mr. Rench includes (a) 84,279 shares issuable upon the exercise

of options exercisable within 60 days of March 5, 2009, (b) 3,905 shares of unvested restricted stock, and

(c) 3,046 shares held by his spouse.

(17) The number of shares beneficially owned by Mr. Camara includes (a) 102,894 shares issuable upon the

exercise of options exercisable within 60 days of March 5, 2009 and (b) 4,986 shares of unvested restricted

stock.

37