Redbox 2008 Annual Report Download - page 41

Download and view the complete annual report

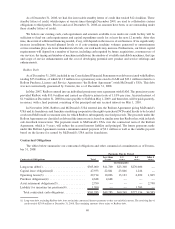

Please find page 41 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of 2008 we entered into another interest rate swap agreement with JP Morgan Chase for a notional amount of

$75.0 million to hedge against the potential impact on earnings from the increase in market interest rates associated

with the interest payments on our variable-rate revolving credit facility. One of our risk management objectives and

strategies is to lessen the exposure of variability in cash flow due to the fluctuation of market interest rates and lock

in an interest rate for the interest cash outflows on our revolving debt. Under the interest rate swap agreements, we

receive or make payments on a monthly basis, based on the differential between a specific interest rate and one-

month LIBOR. The interest rate swaps are accounted for as a cash flow hedge in accordance with FASB Statement

No. 133, Accounting for Derivative Instruments and Hedging Activities. As of December 31, 2008, the fair value of

the swaps, which was $7.5 million, was recorded in other comprehensive income, net of tax of $2.9 million, with the

corresponding adjustment to other accrued liabilities in our Consolidated Financial Statements. We reclassify a

corresponding amount from accumulated other comprehensive income to the consolidated statement of operations

as the interest payments are made. The net gain or loss included in our consolidated statement of operations

representing the amount of hedge ineffectiveness is inconsequential. The term of the $150.0 million swap is through

March 20, 2011. The term of the $75.0 million swap is through October 28, 2010.

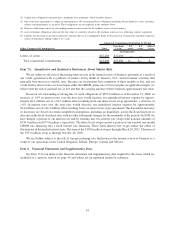

Subject to applicable conditions, we may elect interest rates on our revolving borrowings calculated by

reference to (i) the British Bankers Association LIBOR rate (the “LIBOR Rate”) fixed for given interest periods or

(ii) the highest of Bank of America’s prime rate, (the average rate on overnight federal funds plus one half of one

percent, or the LIBOR Rate fixed for one month plus one percent) (the “Base Rate”), plus, in each case, a margin

determined by our consolidated leverage ratio. For swing line borrowings, we will pay interest at the Base Rate, plus

a margin determined by our consolidated leverage ratio. For borrowings made with the LIBOR Rate, the margin

ranges from 250 to 350 basis points, while for borrowings made with the Base Rate, the margin ranges from 150 to

250 basis points.

As of December 31, 2008, our weighted average interest rate on the revolving line of credit facility was 2.2%

which was based on the debt agreement before the amendment. For borrowing made with the LIBOR Rate, the

margin ranged from 75 to 175 basis points, while for borrowings made with the Base Rate, the margin ranged from

0 to 50 basis points.

The credit facility contains customary negative covenants and restrictions on actions including, without

limitation, restrictions on indebtedness, liens, fundamental changes or dispositions of our assets, payments of

dividends or common stock repurchases, capital expenditures, investments, and mergers, dispositions and acqui-

sitions, among other restrictions. In addition, the credit agreement requires that we meet certain financial covenants,

ratios and tests, including maintaining a maximum consolidated leverage ratio and a minimum interest coverage

ratio, as defined in the credit agreement. As of December 31, 2008, we were in compliance with all covenants.

Previous to November 20, 2007, we were a party to a credit agreement entered into on July 7, 2004, with a

syndicate of lenders led by JPMorgan Chase Bank and Lehman Brothers, Inc. The senior secured credit facility

provided for advances totaling up to $310.0 million, consisting of a $60.0 million revolving credit facility and a

$250.0 million term loan facility. On November 20, 2007, all outstanding debt on this facility was paid in full

resulting in a charge totaling $1.8 million for the write-off of deferred financing fees.

Under the terms of our credit facility, we are permitted to repurchase up to (i) $25.0 million of our common

stock plus (ii) proceeds received after November 20, 2007, from the issuance of new shares of capital stock under

our employee equity compensation plans. Subsequent to November 20, 2007 and as of December 31, 2008, the

authorized cumulative proceeds received from option exercises or other equity purchases under our equity

compensation plans totaled $9.2 million bringing the total authorized for purchase under our credit facility to

$34.2 million. After taking into consideration our share repurchases of $6.5 million subsequent to November 20,

2007, the remaining amount authorized for repurchase under our credit facility is $27.7 million as of December 31,

2008, however we will not exceed our repurchase limit authorized by the board of directors as outlined below.

Apart from our credit facility limitations, our board of directors authorized the repurchase of up to

$22.5 million of our common stock plus additional shares equal to the aggregate amount of net proceeds received

after January 1, 2003, from our employee equity compensation plans. As of December 31, 2008, this authorization

allowed us to repurchase up to $23.9 million of our common stock.

39