Redbox 2008 Annual Report Download - page 114

Download and view the complete annual report

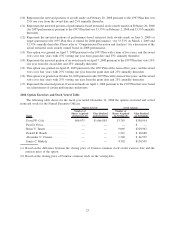

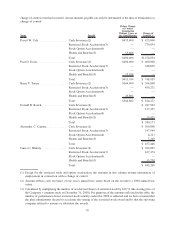

Please find page 114 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.monthly installments over one year from the date of grant and have a term of five years. The FAS 123R value of

the stock options forfeited by Mr. Grinstein in 2008 was $14,501.

(4) Mr. Ahitov was appointed to the Board of Directors on May 28, 2008. Mr. Ahitov’s cash fees are paid to

Shamrock Capital Advisors, Inc., where Mr. Ahitov is a Vice President and Portfolio Manager.

(5) Ms. Bevier was appointed Chair of the Board of Directors effective October 14, 2008, to succeed Mr. Grinstein

who died in September 2008. During 2008, Ms. Bevier did not receive additional equity compensation for her

service as Chair.

(6) Fees paid to Ms. Bevier and Messrs. Grinstein and Rouleau in 2008 include $1,000 paid to each for attendance

at a Nominating and Governance Committee Meeting on October 4, 2007.

(7) For his services on the Redbox board of directors, Mr. Grinstein received $1,500 per meeting attended in person

and $750 per meeting attended telephonically during the first quarter of 2008. During the first quarter of 2008,

Mr. Grinstein attended three Redbox board meetings. Coinstar paid Mr. Grinstein a total of $3,000 for Redbox

board service in the first quarter of 2008. In addition, Coinstar paid Mr. Grinstein $750 in 2008 for

underpayment for Redbox board attendance in 2007 that was adjusted in 2008. For the second and third

quarters of 2008, Redbox paid director fees of $8,000 per quarter to Mr. Grinstein.

(8) Mr. Rouleau resigned from the Board of Directors effective July 23, 2008 and his restricted stock awards and

stock options were accelerated at that time. As a result of the acceleration of his awards, the FAS 123R

incremental increase in expense as of the date of acceleration was $30,727 for the stock options and $65,717 for

the restricted stock. These values are included in the table.

Time and Manner of Compensation

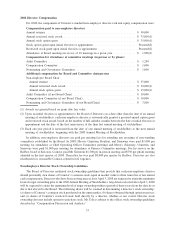

Cash compensation for attending committee meetings is paid at the end of each fiscal quarter. Annual cash

retainers for service as a director or committee chairperson are paid in quarterly installments at the same time as

committee meeting fees are paid. Directors may elect to receive their compensation in the form of Coinstar common

stock rather than cash. If the director elects to receive Coinstar common stock, the director will receive the number

of whole shares that may be purchased at the fair market value on the last day of the fiscal quarter with the

compensation otherwise payable in cash. Any balance of compensation remaining after the whole shares are issued

is then paid in cash. In the past, we allowed directors to defer portions of their annual cash compensation into tax-

deferred interest-bearing accounts pursuant to the Outside Directors’ Deferred Compensation Plan. Effective

January 1, 2005, we suspended future deferrals under the plan due to low participation. Directors who had

previously deferred a portion of their cash compensation continue to maintain interests in the plan. Since no

deferrals were made after December 31, 2004, the plan is not subject to Section 409A of the Code.

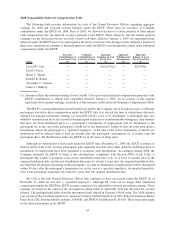

Pursuant to a non-employee director program administered under the 1997 Plan, as amended on June 4, 2007,

stock options and restricted stock awards are automatically awarded upon initial election or appointment to the

Board of Directors and following each annual meeting of stockholders. The terms of these awards are described in

footnotes 2 and 3 to the table above. Stock options are granted with exercise prices equal to the per share fair market

value of Coinstar common stock on the date of grant.

32