Redbox 2008 Annual Report Download - page 110

Download and view the complete annual report

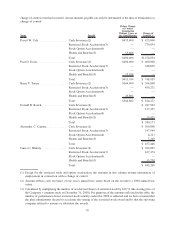

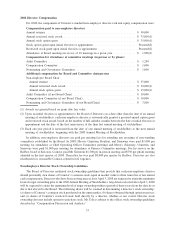

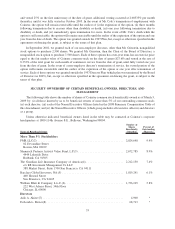

Please find page 110 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For purposes of all of the change-of-control agreements, “change of control” is generally defined as:

• a board change in which individuals who constitute the board as of the date of the agreement cease to

constitute at least a majority of the board;

• the acquisition by any individual, entity, or group of beneficial ownership of (a) 20% or more of either the

then outstanding common stock or the combined voting power of the then outstanding voting securities

entitled to vote in the election of directors, which acquisition is not approved in advance by a majority of the

incumbent directors, or (b) 33% or more of either the then outstanding common stock or the combined

voting power of the then outstanding voting securities entitled to vote in the election of directors, which

acquisition is approved in advance by a majority of incumbent directors;

• a reorganization, merger, or consolidation approved by the stockholders; or

• a complete liquidation, dissolution, or the sale or other disposition of all or substantially all of the assets.

Change-of-Control Provisions in the Company’s Equity Plans. The 1997 Plan provides that the plan

administrator retains the discretion to do one or more of the following in the event of a merger, reorganization,

or sale of substantially all of the assets of Coinstar:

• arrange to have the surviving or successor entity or any parent entity thereof assume the options or grant

replacement options with appropriate adjustments in the option prices and adjustments in the number and

kind of securities issuable upon exercise;

• shorten the period during which options are exercisable;

• accelerate any vesting schedule to which an option is subject; or

• cancel vested options in exchange for a cash payment upon such terms and conditions as determined by the

Board of Directors at the time of the event.

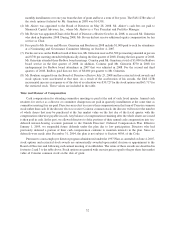

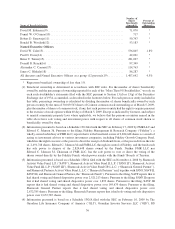

Since December 2005, the Compensation Committee has granted stock options and restricted stock awards

under the 1997 Plan to certain executive officers that provide for accelerated vesting upon a merger, reorganization,

or sale of substantially all of the assets of Coinstar, as follows:

• Options granted to Messrs. Cole, Davis, and Turner since December 2005 fully accelerate in vesting, and the

earned restricted stock awards granted to them are no longer subject to forfeiture.

• Options and earned restricted stock awards granted to our other Named Executive Officers since

December 2005 accelerate in vesting and, with respect to the earned restricted stock, are no longer subject

to forfeiture, if a successor company does not assume or substitute such awards. In the event the options and

earned restricted stock awards are assumed or substituted and the Named Executive Officer’s employment or

service relationship is terminated in connection with a change of control or within one year of the transaction

without cause or by the executive for good reason, 50% of the unvested portions of the options and earned

restricted stock awards automatically vest and, with respect to the earned restricted stock, are no longer

subject to forfeiture. For purposes of these awards, “cause” and “good reason” are defined as described

below under the 2000 Plan.

The 2000 Amended and Restated Equity Incentive Plan (the “2000 Plan”) generally defines “company

transaction” as:

• a dissolution, liquidation, or sale of substantially all of the assets of the Company;

• a merger or consolidation in which the Company is not the surviving corporation; or

• a reverse merger in which the Company is the surviving corporation but the shares of the Company’s

common stock outstanding immediately preceding the merger are converted by virtue of the merger into

other property, whether in the form of securities, cash, or otherwise.

The 2000 Plan provides that in the event of a company transaction (as defined above) (i) any surviving

corporation or a parent of such surviving corporation will assume or substitute awards or (ii) such awards will

28