Redbox 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.through 23,000 point-of-sale terminals, 400 stand-alone E-payment kiosks and 11,000 E-payment-enabled coin-

counting machines in supermarkets, drugstores, universities, shopping malls and convenience stores.

We have relationships with national wireless carriers, such as Sprint, Verizon, T-Mobile, Virgin Mobile and

AT&T. We generate revenue primarily through commissions or fees charged per E-payment transaction and pay our

retailers a fee based on commissions earned on the sales of E-payment services.

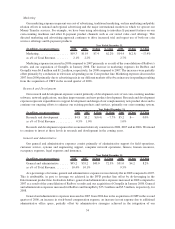

Our E-payment segment revenue and segment operating income for 2008 were $24.5 and $2.2 million (9% of

segment revenue). The costs included $16.0 million of direct operating expenses, $1.3 million of marketing

expenses, $1.1 million of research and development expenses and $3.9 million of general and administrative

expenses. The direct operating expenses were primarily the fees paid to our retailers as well as field support related

costs. Our reported segment operating income of $2.2 million was favorably impacted by a legal settlement of

$2.0 million in the second quarter of 2008. Excluding the effect of this settlement on our E-payment segment

operating income, we would have reported segment operating income of $0.2 million. This reflects the high cost of

investment and our focus on domestic and international expansion in this high growth industry in recent periods,

specifically with our expansion in the United Kingdom gift card services.

Subsequent Events

On February 12, 2009, we entered into a Purchase and Sale Agreement (the “GAM Purchase Agreement”) with

GetAMovie Inc. (“GAM”), pursuant to which we agreed to acquire (i) GAM’s 44.4% voting interests (the

“Interests”) in Redbox and (ii) GAM’s right, title and interest in a Term Promissory Note dated May 3, 2007 made

by Redbox in favor of GAM in the principal amount of $10.0 million (the “Note”), in exchange for a combination of

cash and our common stock, par value $0.001 per share (the “Common Stock”).

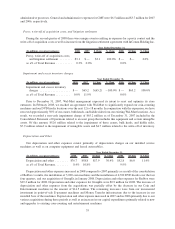

As part of the GAM Purchase Agreement, we will initially pay to GAM cash in the amount of $10.0 million

and deliver to GAM 1.5 million shares of Common Stock (the “Initial Consideration”) on the closing date, which,

subject to fulfillment or waiver of customary closing conditions, is expected to be on February 26, 2009. In addition

to the Initial Consideration, we will pay deferred consideration to GAM in cash and/or shares of Common Stock at

our election and subject to the satisfaction of certain conditions at one or more later dates, with at least 50% of such

deferred consideration payable by July 31, 2009 and the remaining 50% payable by October 30, 2009 (the

“Deferred Consideration” and together with the Initial Consideration, the “Total Consideration”), subject to

mandatory prepayment on the occurrence of certain events. The amount of Deferred Consideration to be paid will

be based upon a schedule that we will deliver to GAM on the business day immediately preceding the closing date of

the transaction. The total amount of Deferred Consideration will ultimately depend upon the amount of Initial

Consideration paid by us and the months in which we pay such Deferred Consideration, with Coinstar paying less

Deferred Consideration to the extent that we pay more Initial Consideration on the closing date. The Total

Consideration to be paid to GAM is expected to be between approximately $134.0 million and $151.0 million. Any

consideration paid in shares of Common Stock will be paid in newly issued, unregistered shares of Common Stock

and will be valued based on the average of the volume weighted average price per share of Common Stock for each

of the eight NASDAQ trading days prior to, but not including, the date of issuance (the “VWAP Price”). The GAM

Purchase Agreement provides that in no event will the shares of Common Stock issued to GAM as consideration

exceed 5,653,398 shares. In addition, if certain conditions are not met, we will not have the option to pay Deferred

Consideration in shares of Common Stock, including if such payment would cause GAM to beneficially hold

greater than 9.9% of our outstanding Common Stock.

The consummation of the transaction contemplated by the GAM Purchase Agreement is subject to various

conditions (or applicable waivers of such conditions), including, but not limited to, a VWAP Price of not less than

$15 per share of Common Stock at the closing date. The GAM Purchase Agreement contains customary

representations and warranties between us and GAM for such a transaction, as well as certain covenants restricting

us from operating outside the ordinary course of business until the Total Consideration has been paid.

In connection with the transaction with GAM, we expect to purchase the remaining outstanding interests of

Redbox from minority interest and non-voting interest holders in Redbox. Consideration to be paid by Coinstar for

these remaining interests will be paid on similar terms to those of the GAM Purchase Agreement, with the minority

interest and non-voting interest holders receiving for their respective interests initial consideration in cash and/or

27