Redbox 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

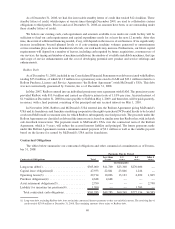

Amortization of Intangible Assets

Our amortization expense consists of amortization of intangible assets, which are mainly comprised of the

value assigned to our acquired retailer relationships and, to a lesser extent, internally developed software.

(In millions, except percentages) 2008 2007 $ Chng % Chng 2006 $ Chng % Chng

Year Ended December 31,

Amortization of intangible assets ...... $9.1 $7.3 $1.8 24.7% $6.2 $1.1 17.7%

as a% of Total Revenue ............. 1.0% 1.3% 1.2%

Amortization expense increased in 2008 compared to 2007 primarily as a result of intangible assets derived

from our Redbox and GroupEx acquisitions. Amortization of intangible assets increased in 2007 compared to 2006

due to the full-year amortization related to our various acquisitions, including CMT in 2006.

Other Income and Expense

(In millions, except percentages) 2008 2007 $ Chng % Chng 2006 $ Chng % Chng

Year Ended December 31,

Foreign currency (loss) gain

and other ............. $ (3.9) $ 0.7 $ (4.6) ⫺657.1% $ 0.2 $ 0.5 250.0%

Interest income .......... 1.2 1.7 (0.5) ⫺29.4% 1.4 0.3 21.4%

Interest expense .......... (21.7) (17.1) (4.6) 26.9% (15.7) (1.4) 8.9%

Loss (income) from equity

investments and other .... (0.3) 1.3 (1.6) ⫺123.1% (0.1) 1.4 ⫺1400.0%

Early retirement of debt .... — (1.8) 1.8 ⫺100.0% (0.2) (1.6) 800.0%

Minority interest ......... $(14.4) $ — $(14.4) 100.0% $ — $ — 0.0%

Foreign currency (loss) gain and other decreased in 2008 as compared to 2007 primarily due to the impact from

the unfavorable movement of foreign exchange rates related to our foreign subsidiaries during 2008. Foreign

currency gains increased from 2006 to 2007 due to increased international operations and the movement of foreign

exchange rates related to our foreign subsidiaries.

Interest income decreased for 2008 compared to 2007 due to lower invested balances and a decrease in interest

rates. Interest income increased in 2007 from 2006 primarily due to the recognition of interest income on our

telecommunication fee refund offset by lower average year over year investment balances.

Interest expense increased in 2008 compared to 2007 due to higher outstanding debt balances. Interest expense

increased in 2007 compared to 2006 primarily due to higher outstanding debt balances, higher interest rates and

increased capital leases.

Loss (income) from equity investments and other decreased in 2008 as compared to 2007 primarily as a result

of the consolidation of Redbox’s results beginning in the first quarter of 2008. Income (loss) from equity

investments and other increased in 2007 from 2006 primarily as a result of recording our portion of the

telecommunication fee refund expected to be collected by us on behalf of a related third party.

Early retirement of debt expense was $1.8 million in 2007 and $0.2 million in 2006. On November 20, 2007, in

connection with entering into our new debt facility, we retired the outstanding balance of our previous debt facility

dated July 7, 2004 resulting in a charge of $1.8 million for the write-off of deferred financing fees. The early

retirement of debt expense in 2006 related to accelerated deferred financing fees related to our mandatory pay down

of $16.9 million under our previous debt facility in the first quarter of 2006.

Minority interest for 2008 represented the operating results for the 49% stake in Redbox that we did not own.

Income Taxes

Our effective income tax rate was 53.4% in 2008 compared with (22.1%) in 2007 and 39.3% in 2006. As

illustrated in Note 11 to the Consolidated Financial Statements, the effective income tax rate for 2008 varies from

the federal statutory tax rate of 35% primarily due to a change in valuation allowance on foreign net operating

36