Redbox 2008 Annual Report Download - page 102

Download and view the complete annual report

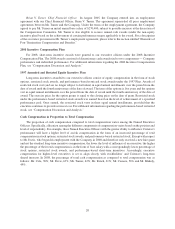

Please find page 102 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Brian V. Turner, Chief Financial Officer. In August 2005, the Company entered into an employment

agreement with our Chief Financial Officer, Brian V. Turner. The agreement superseded all prior employment

agreements between Mr. Turner and the Company. Under the terms of the employment agreement, the Company

agreed to pay Mr. Turner an initial annual base salary of $270,400, subject to possible increase at the discretion of

the Compensation Committee. Mr. Turner is also eligible to receive annual cash awards (under the non-equity

incentive plan) based on the achievement of certain performance targets applicable to the award. For a description

of the severance provisions in Mr. Turner’s employment agreement, please refer to the section entitled “Elements of

Post-Termination Compensation and Benefits.”

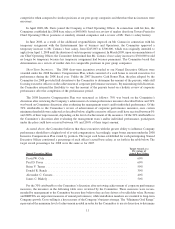

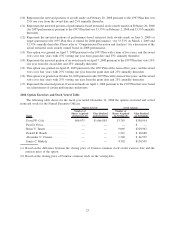

2008 Incentive Compensation Plan

For 2008, short-term incentive awards were granted to our executive officers under the 2008 Incentive

Compensation Plan. The 2008 awards consisted of discretionary cash awards tied to two components — Company

performance and individual performance. For additional information regarding the 2008 Incentive Compensation

Plan, see “Compensation Discussion and Analysis.”

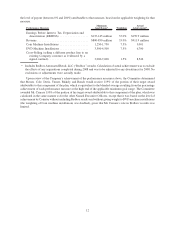

1997 Amended and Restated Equity Incentive Plan

Long-term incentives awarded to our executive officers consist of equity compensation in the form of stock

options, restricted stock awards, and performance-based restricted stock awards under the 1997 Plan. Awards of

restricted stock vest (and are no longer subject to forfeiture) in equal annual installments over the period from the

date of award until the fourth anniversary of the date of award. The term of the options is five years and the options

vest in equal annual installments over the period from the date of award until the fourth anniversary of the date of

award. The exercise price for the option grants is equal to the closing price on the date of grant. Restricted stock

under the performance-based restricted stock awards was earned based on the level of achievement of a specified

performance goal. Once earned, the restricted stock vests in three equal annual installments, provided that the

executive continues to provide services to us. For additional information regarding the performance-based restricted

stock, see “Compensation Discussion and Analysis.”

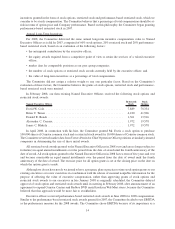

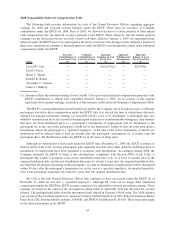

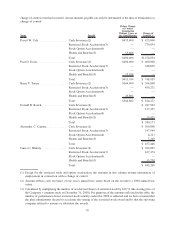

Cash Compensation in Proportion to Total Compensation

The proportion of cash compensation compared to total compensation varies among the Named Executive

Officers. Specifically, allocation among the different components of compensation varies based on the position and

level of responsibility. For example, those Named Executive Officers with the greater ability to influence Coinstar’s

performance will have a higher level of at-risk compensation in the form of an increased percentage of total

compensation in stock options, restricted stock awards, and performance-based restricted stock. Except with respect

to Mr. Davis, who began his employment with the Company in 2008 and therefore only received a new hire grant

and not the standard long-term incentive compensation, the lower the level of influence of an executive, the higher

the percentage of their total compensation is in the form of base salary with a correspondingly lower percentage of

stock options, restricted stock awards, and performance-based short-term incentives. Accordingly, executive

compensation for higher-level executives is set to align closely with stockholders’ and Coinstar’s long-term

shared interests. In 2008, the percentage of total cash compensation as compared to total compensation was as

follows: Mr. Cole, 38%; Mr. Davis, 63%; Mr. Turner, 42%; Mr. Rench, 61%; Mr. Camara, 56% and Mr. Blakely,

49%.

20