Redbox 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

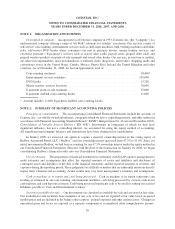

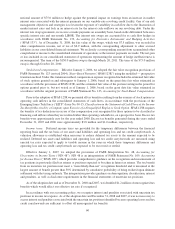

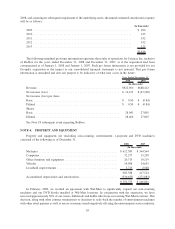

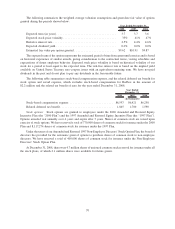

The total purchase consideration has been allocated to the assets acquired and liabilities assumed, including

identifiable intangible assets, based on their respective fair values at the acquisition date. The following condensed

balance sheet data is preliminary and presents the fair value of the assets acquired and liabilities assumed.

(In thousands)

Assets acquired:

Cash and cash equivalents . . . ........................................ $ 26,807

Trade accounts receivable ............................................ 13,531

Prepaid expenses and other assets ...................................... 2,053

Property and equipment ............................................. 4,015

Intangible assets ................................................... 15,300

Goodwill ........................................................ 56,930

118,636

Liabilities assumed:

Accounts payable and accrued liabilities ................................. 46,536

$ 72,100

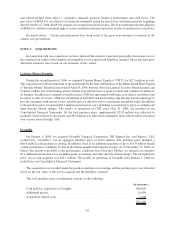

Goodwill of $56.9 million, representing the excess of the purchase price paid over the fair value of the tangible and

identifiable intangible assets acquired, will not be amortized, consistent with the guidance in FASB Statement No. 142,

Goodwill and Other Intangible Assets. An election pursuant to Internal Revenue Code Section 338(h)(10) is being made

for tax purposes so the entire amount of intangibles and goodwill will be amortized and deducted over 15 years. Included

in the liabilities assumed, is an estimated additional payment of $10.0 million which represents our best estimate that

certain performance conditions as defined in the agreement, would be met in the fifteen months following the closing. As

of December 31, 2008, we believe the estimated payout is probable as the performance conditions have been met and we

expect the payment will be made in 2009.

We used forecasted future cash flows to estimate the fair value of the acquired intangible assets and a portion of

the purchase price was allocated to the following identifiable intangible assets:

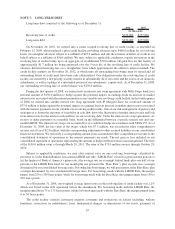

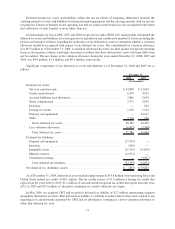

(In thousands)

Intangible assets:

Internal use software ............................................... $ 1,600

Agent relationships................................................. 12,300

Trademark ....................................................... 1,400

Total ............................................................. $15,300

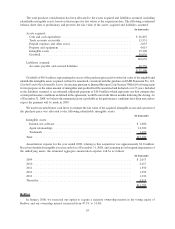

Amortization expense for the year ended 2008, relating to this acquisition was approximately $2.0 million.

Based on identified intangible assets recorded as of December 31, 2008, and assuming no subsequent impairment of

the underlying assets, the estimated aggregate amortization expense will be as follows:

(In thousands)

2009 ............................................................. $ 2,017

2010 ............................................................. 2,017

2011 ............................................................. 1,550

2012 ............................................................. 1,550

2012 ............................................................. 1,230

Thereafter ......................................................... 4,919

$13,283

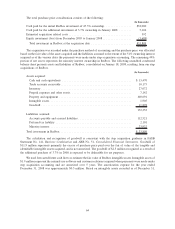

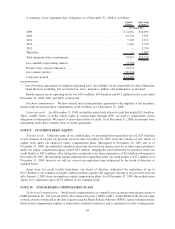

Redbox

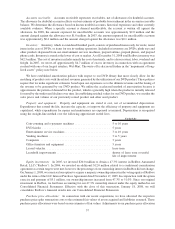

In January 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox and our ownership interest increased from 47.3% to 51.0%.

63