Redbox 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

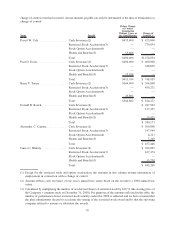

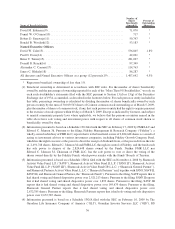

Name of Beneficial Owner

Number of

Shares

Beneficially

Owned(1)

Percent of

Outstanding

Shares(1)

David M. Eskenazy(9)............................................... 71,070 *

Daniel W. O’Connor(10) ............................................. 717 *

Robert D. Sznewajs(11).............................................. 50,747 *

Ronald B. Woodard(12).............................................. 53,183 *

Named Executive Officers

David W. Cole(13) ................................................. 536,865 1.8%

Paul D. Davis(14) .................................................. 42,021 *

Brian V. Turner(15) ................................................. 281,027 *

Donald R. Rench(16) ............................................... 97,349 *

Alexander C. Camara(17) ............................................ 114,763 *

James C. Blakely(18) ............................................... 86,287 *

All directors and Named Executive Officers as a group (12 persons)(19).......... 1,407,642 4.5%

* Represents beneficial ownership of less than 1%.

(1) Beneficial ownership is determined in accordance with SEC rules. For the number of shares beneficially

owned by and the percentage of ownership reported for each of the “More Than 5% Stockholders,” we rely on

each such stockholder’s statements filed with the SEC pursuant to Section 13(d) or 13(g) of the Securities

Exchange Act of 1934, as amended, as described in the footnotes below. For each person or entity included in

this table, percentage ownership is calculated by dividing the number of shares beneficially owned by such

person or entity by the sum of 30,019,563 shares of Coinstar common stock outstanding as of March 5, 2009,

plus the number of shares of common stock, if any, that such person or entity had the right to acquire pursuant

to the exercise of stock options within 60 days of March 5, 2009. Except as indicated by footnote, and subject

to marital community property laws where applicable, we believe that the persons or entities named in the

table above have sole voting and investment power with respect to all shares of common stock shown as

beneficially owned by them.

(2) Information presented is based on a Schedule 13G filed with the SEC on February 17, 2009 by FMR LLC and

Edward C. Johnson 3d. Pursuant to the filing, Fidelity Management & Research Company (“Fidelity”), a

wholly-owned subsidiary of FMR LLC, reports that it is the beneficial owner of 2,824,648 shares as a result of

acting as investment advisor to various investment companies, including Fidelity Growth Company Fund,

which has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, 2,491,748 shares. Edward C. Johnson 3d and FMR LLC, through its control of Fidelity, and the funds each

has sole power to dispose of the 2,824,648 shares owned by the Funds. Neither FMR LLC nor

Edward C. Johnson 3d, Chairman of FMR LLC, has the sole power to vote or direct the voting of the

shares owned directly by the Fidelity Funds, which power resides with the Funds’ Boards of Trustees.

(3) Information presented is based on a Schedule 13D/A filed with the SEC on November 4, 2008 by Shamrock

Activist Value Fund, L.P. (“SAVF”), Shamrock Activist Value Fund II, L.P. (“SAVF II”), Shamrock Activist

Value Fund III, L.P. (“SAVF III”), Shamrock Activist Value Fund GP, L.L.C. (“Shamrock General Partner”),

and Shamrock Partners Activist Value Fund, L.L.C. (“Shamrock Partners” and, together with SAVF, SAVF II,

SAVF III, and Shamrock General Partner, the “Shamrock Funds”). Pursuant to the filing, SAVF reports that it

had shared voting and shared dispositive power over 2,521,213 shares. Pursuant to the filing, SAVF II reports

that it had shared voting and shared dispositive power over 1,893 shares. Pursuant to the filing, SAVF III

reports that it had shared voting and shared dispositive power over 149,679 shares. Pursuant to the filing,

Shamrock General Partner reports that it had shared voting and shared dispositive power over

2,672,785 shares. Pursuant to the filing, Shamrock Partners reports that it had sole voting and sole dispositive

power over 2,672,785 shares.

(4) Information presented is based on a Schedule 13G/A filed with the SEC on February 10, 2009 by The

Guardian Life Insurance Company of America (“GLI”), Guardian Investor Services LLC (“GIS”), RS

36