Redbox 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

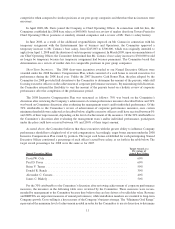

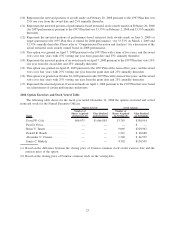

For the 30% attributable to the Committee’s discretion after evaluating the management team’s and/or

individual performance, the Committee considered the recommendations of the Chief Executive Officer and the

Chief Operating Officer for each of the other Named Executive Officers and conducted its own evaluation of the

Chief Executive Officer and Chief Operating Officer. The following table summarizes the individual performance

factors evaluated by the Committee for each Named Executive Officer and the percentage payout approved by the

Committee for this component of the plan:

Named Executive Officer Individual Performance Factors Payout %

David W. Cole....... High involvement with Redbox, including serving on its board and

negotiating purchase of Redbox shares from McDonald’s; established

strategic relationship with Wal-Mart; led proxy contest settlement; led

process to hire Chief Operating Officer and implement succession plan;

restructured Entertainment and E-Pay line of business leadership.

100%

Paul D. Davis ....... Gainedrespectofleadershipteam;inprocessofexecutingseamless

transition to Chief Executive Officer position; improved level of

accountability for other leaders; high involvement with Redbox, including

serving on its board; developed management and Company strategic plans.

100%

Brian V. Turner ...... Coordinated proxy contest activities; completed acquisition of GroupEx;

high involvement with Redbox, including serving on its board; strong

financial stewardship during difficult economic year; negotiated

favorable credit terms; developed/evaluated new product line.

80%

Donald R. Rench ..... Ledlegal team during proxy contest; successful settlement/resolution of

litigation; completed closing of GroupEx; high involvement in Redbox,

including acquisition of Redbox shares from McDonald’s; strong support

for board/committee meetings.

135%

Alexander C. Camara. . Instrumental in strong Coin machine installations; strong execution of

Wal-Mart relationship; decreased certain expenses for line of business;

increased morale, teamwork, and execution in the Entertainment line of

business.

90%

James C. Blakely ..... Ledteam in strong Coin and DVD machine installations, including

Redbox; led team in strong cross-selling results; instrumental in Wal-

Mart relationship.

100%

Overall, the total cash bonuses paid to our Named Executive Officers under the 2008 Incentive Compensation

Plan ranged from 104% to 123% of each of their respective target bonus amounts. Total individual cash bonuses

paid to each of our Named Executive Officers for 2008 consisted of the following:

Named Executive

Officer

Discretionary Bonus

Based on Company

Performance

Discretionary Bonus

Based on Individual

Performance Total Bonus

David W. Cole ........................ $236,363 $85,500 $321,863

Paul D. Davis ......................... 146,347 52,938 199,285

Brian V. Turner........................ 150,941 43,680 194,621

Donald R. Rench ...................... 61,580 22,275 83,855

Alexander C. Camara ................... 89,175 31,163 120,338

James C. Blakely ...................... 108,644 53,055 161,699

Long-Term Incentives. Long-term incentives awarded to our executive officers consist of equity compen-

sation in the form of stock options, restricted stock awards and performance-based restricted stock awards. All long-

term incentive grants to the Named Executive Officers are approved by the Committee. Annual long-term incentive

grants are typically granted at the beginning of the service period for which the awards are granted (i.e., the long-

term incentive grants for performance in 2007 were made in February 2007) in order to motivate and retain the

executive for the upcoming year. The Committee also periodically makes promotional or new hire option grants.

The Committee believes that stock ownership is an essential tool to align the interests of our executives and

stockholders. Generally, the higher the level of the executive’s position, the greater the percentage of long-term

13