Redbox 2008 Annual Report Download - page 120

Download and view the complete annual report

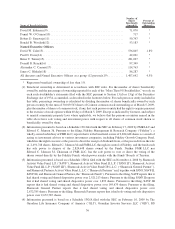

Please find page 120 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(18) The number of shares beneficially owned by Mr. Blakely includes (a) 76,894 shares issuable upon the exercise

of options exercisable within 60 days of March 5, 2009 and (b) 4,986 shares of unvested restricted stock.

(19) The number of shares beneficially owned by all directors and Named Executive Officers (which group

includes all executive officers) as a group includes (a) 1,173,773 shares issuable upon the exercise of options

exercisable within 60 days of March 5, 2009 and (b) 77,648 shares of unvested restricted stock.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Policies and Procedures for the Review and Approval or Ratification of Transactions with Related

Persons

Our Board of Directors has adopted a written policy for the review and approval or ratification of related person

transactions. Under the policy, our directors and executive officers and the beneficial owners of 5% of our common

stock or other voting securities are expected to disclose to our General Counsel the material facts of any transaction

that could potentially be considered a related person transaction promptly on gaining knowledge that the transaction

may occur or has occurred. The Audit Committee is authorized to administer this policy, and may amend, modify,

and interpret this policy, and take such other action in connection with the administration of the policy, as it deems

necessary or desirable; provided, however, any material amendments or modifications to this policy will be

recommended to the full Board for its review and approval.

A related person transaction generally is defined as any transaction required to be disclosed under the SEC’s

related person transaction disclosure requirement of Item 404(a) of Regulation S-K.

Any potential related person transaction reported to or otherwise made known to the General Counsel is

reviewed according to the following procedures:

• If the General Counsel determines that disclosure of the transaction in our annual proxy statement or annual

report on Form 10-K is not required under the SEC’s related person transaction requirement, the transaction

will be deemed approved and will be reported to the Audit Committee at its next scheduled meeting.

• If disclosure of the transaction in our annual proxy statement or annual report on Form 10-K is required

under the SEC’s related person transaction requirement, the General Counsel will submit the transaction to

the chairperson of the Audit Committee, who will review and, if authorized, will determine whether to

approve or ratify the transaction. The chairperson is authorized to approve or ratify any related person

transaction involving an aggregate amount of less than $1 million or when it would not be practicable in the

judgment of the chairperson and General Counsel to wait for the next Audit Committee meeting to review

the transaction.

• If the transaction is outside the chairperson’s authority, the chairperson will submit the transaction to the

Audit Committee for review and approval or ratification.

• If the transaction to be reviewed and acted upon by the Audit Committee involves a member of the Audit

Committee (including the chairperson), the involved member shall recuse himself or herself from delib-

erations related to the transaction and the other members of the Committee shall take appropriate action.

When determining whether to approve or ratify a related person transaction, the chairperson of the Audit

Committee or the Audit Committee, as applicable, will review relevant facts regarding the related person

transaction, including:

• the extent of the related person’s interest in the transaction;

• whether the terms are comparable to those generally available in arm’s-length transactions; and

• whether the related person transaction is consistent with the best interests of the Company.

If any related person transaction is ongoing or is part of a series of transactions, the chairperson or the

Committee, as applicable, may establish guidelines as necessary to appropriately review the ongoing transaction.

After initial approval or ratification of the transaction, the chairperson or the Committee, as applicable, will review

the transaction on a regular basis (at least annually).

38