Redbox 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.how resources should be allocated among our business segments. For example, if a segment’s revenue decreases

more than expected, our CEO may consider allocating less financial or other resources to that segment in the future.

See Note 15 in the Consolidated Financial Statements for additional information regarding business segments.

Coin and Entertainment services

We are the leader in the self-service coin-counting services market and are the leading owner and operator of

skill-crane and bulk vending machines in the United States. We own and operate the only multi-national fully

automated network of self-service coin-counting machines across the United States, Canada, Puerto Rico, Ireland

and in the United Kingdom. We estimate that at any one time, there is more than $10.5 billion worth of coin sitting

idle in households in the United States. In 2008, consumers processed more than $3.0 billion worth of coin through

our coin-counting machines.

We own and service all of our coin-counting and entertainment services machines, providing a convenient and

trouble free service to retailers. Coin-counting revenue is generated through transaction fees from our customers

and business partners. Consumers feed loose change into the machines, which count the change and then dispense

vouchers or, in some cases, issue E-payment products, at the consumer’s election. Each voucher lists the dollar

value of coins counted, less our transaction fee, which is typically 8.9% of the value of coins counted. When

consumers elect to have a stored value card or e-certificate issued, the transaction fee normally charged to the

consumer is charged instead to the card issuers for the coin-counting services.

We launched our business in North America with the installation of the first Coinstar»coin-counting machine

in the early 1990s, and in 2001 we began offering our coin services in the United Kingdom, and we expanded into

Ireland during 2008. Since inception, our coin-counting machines have counted and processed more than

393.4 billion coins worth more than $21.6 billion in more than 583.1 million self-service coin-counting trans-

actions. We own and operate more than 18,400 coin-counting machines in the United States, Canada, Puerto Rico,

Ireland and the United Kingdom (approximately 11,000 of which are E-payment enabled).

Our entertainment services machines consist primarily of skill-crane machines, bulk vending and kiddie rides,

which are installed in more than 16,000 retail locations, totaling more than 145,000 pieces of equipment. We

generate revenue from money deposited in our machines that dispense plush toys, novelties and other items.

In February 2008, we reached an agreement with Wal-Mart to remove approximately 50% of our cranes, bulk

heads, and kiddie rides from our existing Wal-Mart locations during the first two quarters of 2008. Accordingly, we

anticipate making certain resource re-allocations and will continue to evaluate any appropriate restructuring in this

area in an effort to control operating expenses. Ultimately, any resource allocations will depend on the interplay

between the net number of entertainment machines coming out of, and coin-counting and DVD machines going in

to, Wal-Mart locations.

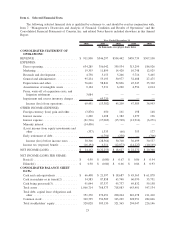

Our Coin and Entertainment services segment revenue and segment operating income for 2008 totaled

$411.5 million and $98.9 million (24% of segment revenue). The costs relating to this segment included

$267.0 million of direct operating expenses, $7.9 million of marketing expenses, $3.5 million of research and

development expenses, and $34.2 million of general and administrative expenses. The direct operating expenses

mainly consisted of fees and commissions paid to our retailers, coin pick-up transportation and processing fees,

plush toys and products dispensed from the skill-crane and bulk-vending machines, as well as the field operation

support. This segment’s operating margin of 24% of segment revenue was mainly due to a more mature business as

compared to our other segments, and generates relatively more favorable profit margin based on the variable nature

of the expenses and our ability to control expenses as revenue fluctuates. For example, as revenue increases or

decreases due to market conditions, we have been able to control our field service team expenses to coincide with

the relative increase or decrease in revenue.

DVD services

On January 1, 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox under the terms of the LLC Interest Purchase Agreement dated November 17, 2005. In conjunction with the

option exercise and payment of $5.1 million, our ownership interest increased from 47.3% to 51.0%. Since our

25