Redbox 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

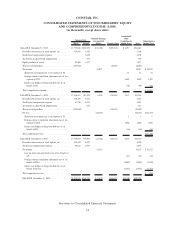

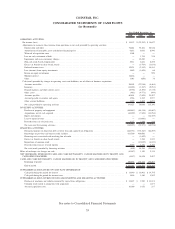

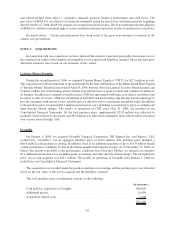

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

2008 2007 2006

Year Ended December 31,

OPERATING ACTIVITIES:

Net income (loss) . ............................................................. $ 14,112 $ (22,253) $ 18,627

Adjustments to reconcile (loss) income from operations to net cash provided by operating activities:

Depreciation and other . ........................................................ 76,661 58,841 52,836

Amortization of intangible assets and deferred financing fees . . ................................ 9,612 8,043 6,980

Write-off of acquisition costs . . ................................................... 1,004 — —

Loss on early retirement of debt . ................................................... — 1,794 238

Impairment and excess inventory charges .............................................. — 65,220 —

Non-cash stock-based compensation . . . .............................................. 8,811 6,421 6,258

Excess tax benefit on share based awards .............................................. — (3,764) (1,033)

Deferred income taxes. . ........................................................ 12,121 (9,142) 10,183

Loss (income) from equity investments. . .............................................. 3,449 (1,624) 66

Return on equity investments . . ................................................... — — 929

Minority interest ............................................................. 14,436 — —

Other . . . ................................................................. 1,083 (656) 38

Cash (used) provided by changes in operating assets and liabilities, net of effects of business acquisitions:

Accounts receivable . . . ........................................................ 26,503 (27,016) (8,464)

Inventory ................................................................. (33,078) (3,547) (9,253)

Prepaid expenses and other current assets .............................................. (8,772) (8,594) (3,138)

Other assets . . . ............................................................. (481) (4,773) (444)

Accounts payable ............................................................ 60,801 (7,624) 25,507

Accrued payable to retailers and agents . .............................................. 4,526 2,535 9,977

Other accrued liabilities . ........................................................ 1,039 4,205 6,073

Net cash provided by operating activities .............................................. 191,827 58,066 115,380

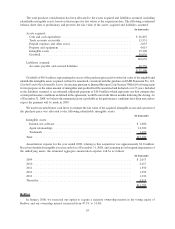

INVESTING ACTIVITIES:

Purchase of property and equipment . . . .............................................. (163,643) (84,318) (45,867)

Acquisitions, net of cash acquired ................................................... (24,829) (7,249) (31,254)

Equity investments ............................................................ — — (12,109)

Loan to equity investee . ........................................................ — (10,000) —

Proceeds from sale of fixed assets ................................................... 3,237 2,294 254

Net cash used by investing activities . . . .............................................. (185,235) (99,273) (88,976)

FINANCING ACTIVITIES:

Principal payments on long-term debt, revolver loan and capital lease obligations ...................... (442,731) (338,543) (24,209)

Borrowings on previous and current credit facilities . . . ..................................... 433,500 400,500 —

Financing costs associated with revolving line of credit . ..................................... — (1,692) —

Excess tax benefit on share based awards .............................................. — 3,764 1,033

Repurchase of common stock . . ................................................... — (10,025) (8,023)

Proceeds from exercise of stock options . .............................................. 8,629 4,281 5,357

Net cash (used) provided by financing activities . ......................................... (602) 58,285 (25,842)

Effect of exchange rate changes on cash .................................................. (10,547) 1,350 2,335

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS, CASH IN MACHINE OR IN TRANSIT, AND

CASH BEING PROCESSED ....................................................... (4,557) 18,428 2,897

CASH AND CASH EQUIVALENTS, CASH IN MACHINE OR IN TRANSIT, AND CASH BEING PROCESSED:

Beginning of period . . . ........................................................ 196,592 178,164 175,267

End of period . . ............................................................. $192,035 $ 196,592 $178,164

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the period for interest . .............................................. $ 18,990 $ 18,901 $ 14,795

Cash paid during the period for income taxes . . . ......................................... 3,636 3,480 1,982

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES:

Purchase of machines and vehicles financed by capital lease obligations . ........................... $ 21,497 $ 9,700 $ 13,811

Common stock issued in conjuction with acquisition . . ..................................... — — 1,673

Accrued acquisition costs ........................................................ 10,000 1,051 217

See notes to Consolidated Financial Statements

55