Redbox 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

vest on a straight-line basis over three to four years. Holders of redeemable Class B interests have a one-time right,

during the 90-day period commencing December 1, 2012, to require Redbox to redeem their vested redeemable

Class B interests at fair value. The redeemable Class B interests are accounted for under SFAS 123R based on the

fair value of awards at the end of the period. Total compensation expense under the REEIP was $2.2 million and the

related tax benefit was zero for Redbox for the year ended 2008. The unrecognized stock compensation under the

REEIP was $5.1 million at December 31, 2008, which will be recognized over approximately two years. Upon

closing the Redbox transactions, as discussed in Note 18, the REEIP may be re-evaluated.

NOTE 11: INCOME TAXES

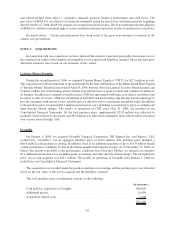

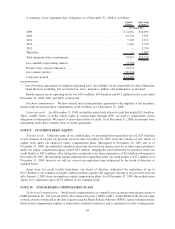

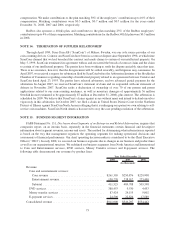

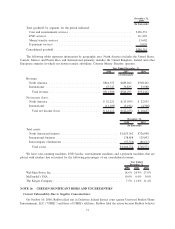

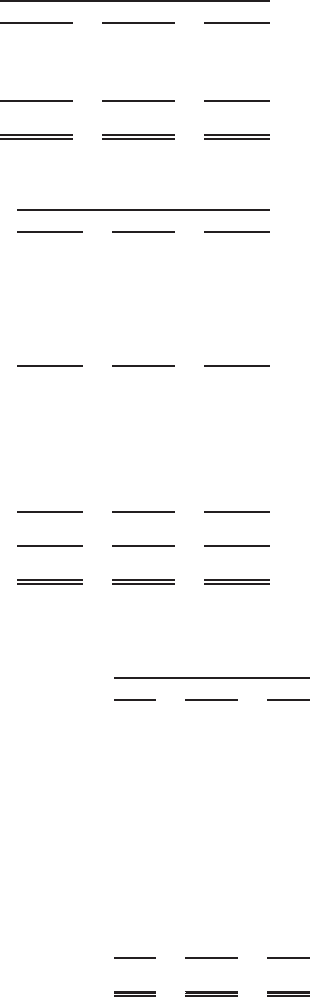

The components of income (loss) before income taxes were as follows:

2008 2007 2006

December 31,

(In thousands)

United States operations ............................... $40,429 $(17,945) $36,175

Foreign operations.................................... (10,123) (10,619) (5,475)

Total income (loss) before taxes ........................ $30,306 $(28,564) $30,700

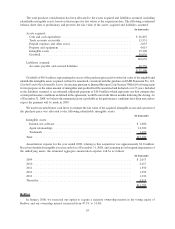

The components of income tax (benefit) expense were as follows:

2008 2007 2006

December 31,

(In thousands)

Current:

United States federal.................................. $ 2,962 $ 1,216 $ 826

State and local ...................................... 159 1,692 617

Foreign ........................................... 952 (77) 447

Total current ...................................... 4,073 2,831 1,890

Deferred:

United States federal.................................. $10,279 $(6,707) $ 9,519

State and local ...................................... 2,248 (1,461) 2,079

Foreign ........................................... (406) (974) (1,415)

Total deferred ..................................... 12,121 (9,142) 10,183

Total tax expense (benefit) ............................... $16,194 $(6,311) $12,073

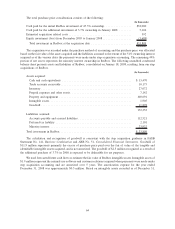

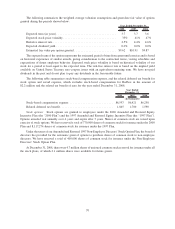

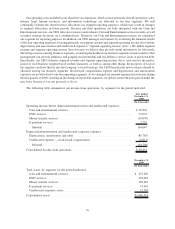

The income tax (benefit) expense differs from the amount that would result by applying the U.S. statutory rate

to (loss) income before income taxes. A reconciliation of the difference follows:

2008 2007 2006

December 31,

U.S. federal tax expense (benefit) at the statutory rate ....................... 35.0% ⫺35.0% 35.0%

State income taxes, net of federal impact ................................. 5.2% ⫺1.9% 4.8%

Incentive stock options .............................................. 2.4% 1.9% 2.1%

Impact of meeting the indefinite reversal criteria for unremitted foreign earnings . . . 0.0% 0.0% ⫺4.8%

State net operating loss carryforward adjustment ........................... ⫺0.1% 2.6% 3.7%

R&D credit ....................................................... ⫺1.5% ⫺0.2% ⫺3.4%

Change in valuation allowance for deferred tax asset ........................ 11.0% 7.0% 1.2%

Foreign rate differential .............................................. 2.4% 1.9% 0.0%

Other ........................................................... ⫺1.0% 1.6% 0.7%

53.4% ⫺22.1% 39.3%

72