Redbox 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued FASB Statement No. 141 (revised 2007), Business Combinations

(“SFAS 141R”). SFAS 141R retains the fundamental requirements of Statement No. 141 to account for all business

combinations using the acquisition method (formerly the purchase method) and for an acquiring entity to be

identified in all business combinations. However, the new standard requires the acquiring entity in a business

combination to recognize all the assets acquired and liabilities assumed in the transaction; establishes the

acquisition-date fair value as the measurement objective for all assets acquired and liabilities assumed; and

requires the acquirer to disclose the information needed to evaluate and understand the nature and financial effect of

the business combination. SFAS 141R is effective for acquisitions made on or after the first day of annual periods

beginning on or after December 15, 2008. The adoption of SFAS 141R will result in the recognition of certain types

of acquisition related expenses in our results of operations that are currently capitalized or related costs that may be

incurred on transactions completed following the adoption of this statement.

In December 2007, the FASB issued FASB Statement No. 160, Noncontrolling Interests in Consolidated

Financial Statements — An Amendment of ARB No. 51 (“SFAS 160”). SFAS 160 establishes new accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary.

SFAS 160 is effective for annual periods beginning on or after December 15, 2008. SFAS 160 will change the

accounting and reporting for minority interests, as well as requiring expanded disclosures.

In March 2008, the FASB issued FASB Statement No. 161, Disclosures about Derivative Instruments and

Hedging Activities (“SFAS 161”). SFAS 161 requires enhanced disclosures about how and why companies use

derivatives, how derivative instruments and related hedged items are accounted for and how derivative instruments

and related hedged items affect a company’s financial position, financial performance and cash flows. The

provisions of SFAS 161 are effective for financial statements issued for fiscal years and interim periods beginning

after November 15, 2008. SFAS 161 requires us to expand certain disclosures. We do not anticipate that the adoption

of SFAS 161 will have a significant impact on our consolidated financial position, results of operations or cash

flows.

Reclassifications

Certain reclassifications have been made to the prior year amounts to conform to the current year presentation.

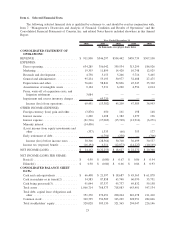

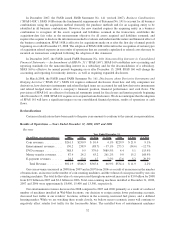

Results of Operations — Years Ended December 31, 2008, 2007 and 2006

Revenue

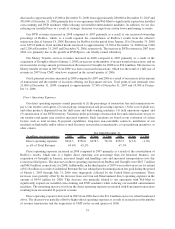

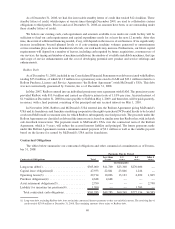

(In millions, except percentages) 2008 2007 $ Chng % Chng 2006 $ Chng % Chng

Year Ended December 31,

Coin revenues............ $261.3 $250.9 $ 10.4 4.1% $229.9 $ 21.0 9.1%

Entertainment revenues ..... 150.2 238.9 (88.7) ⫺37.1% 273.5 (34.6) ⫺12.7%

DVD revenues ........... 388.5 9.5 379.0 3989.5% 4.4 5.1 115.9%

Money transfer revenues .... 87.4 24.2 63.2 261.2% 9.0 15.2 168.9%

E-payment revenues ....... 24.5 22.8 1.7 7.5% 17.6 5.2 29.5%

Total Revenue .......... $911.9 $546.3 $365.6 66.9% $534.4 $ 11.9 2.2%

Our coin revenues increased in 2008 from 2007 and in 2007 from 2006 as a result of an increase in the number

of transactions, an increase in the number of coin counting machines, and the volume of coins processed by our coin

counting machines. The total dollar value of coins processed through our network increased to $3.0 billion for 2008

from $2.9 billion in 2007 and $2.6 billion in 2006. Total coin-counting machines installed at December 31, 2008,

2007 and 2006 were approximately 18,400, 15,400 and 13,500, respectively.

Our entertainment revenues decreased in 2008 compared to 2007 and 2006 primarily as a result of a reduced

number of machines installed in Wal-Mart locations, our decision to resign certain lower performing accounts,

decreased foot traffic at our retailers’ locations, softness in the economy, increased fuel prices, and a deflated

housing market. While we are watching these trends closely, we believe macro economic issues will continue to

negatively affect retailer foot traffic for the foreseeable future. The installed base of entertainment machines

32