Redbox 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

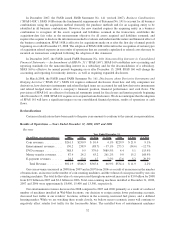

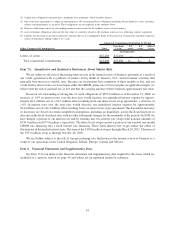

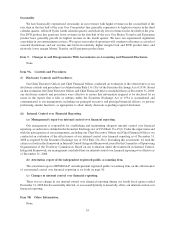

Supplemental Quarterly Financial Information

The following table sets forth selected unaudited quarterly financial information for the last eight quarters.

This information has been prepared on the same basis as our audited Consolidated Financial Statements and

includes, in the opinion of management, all normal and recurring adjustments that management considers necessary

for a fair presentation of the quarterly results for the periods. The operating results for any quarter are not

necessarily indicative of the results for future periods. Certain reclassifications have been made to the prior period

balances to conform with the current year presentation.

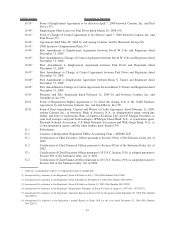

Dec. 31,

2008

Sept. 30,

2008

June 30,

2008(1)

March 31,

2008(2)

Dec. 31,

2007(3)

Sept. 30,

2007(4)

June 30,

2007

March 31,

2007

Three Month Periods Ended

(In thousands, except per share data)

(unaudited)

Consolidated Statement of

Operations:

Revenue . .................. $260,981 $240,497 $219,903 $190,519 $133,314 $143,291 $137,356 $132,336

Expenses:

Direct operating ............ 180,945 168,721 152,009 132,610 85,112 86,721 92,570 91,639

Marketing . . . ............. 5,311 7,374 3,815 2,803 2,009 5,650 2,614 1,626

Research and development . . . . . 1,180 1,157 1,175 1,246 1,070 1,397 1,345 1,341

General and administrative . . . . . 29,472 22,760 23,206 19,796 13,857 15,685 13,404 12,247

Depreciation and other ........ 23,089 17,746 18,855 16,971 14,724 15,100 14,549 14,468

Amortization of intangible

assets ................. 2,213 2,271 2,298 2,342 1,962 1,813 1,817 1,739

Impairment and excess inventory

charges . . . ............. — — — — 65,220 — — —

Proxy, write-off of acquisition

costs, and litigation

settlement. . ............. — — 3,084 — — — — —

Income (loss) from operations . . . . . 18,771 20,468 15,461 14,751 (50,640) 16,925 11,057 9,276

Foreign currency (loss) gain and

other . .................. (1,149) (709) (890) (1,128) 91 699 (20) (120)

Interest income . ............. 155 180 626 259 201 1,109 193 195

Interest expense . ............. (5,490) (5,404) (5,906) (4,916) (4,605) (4,365) (4,125) (3,974)

(Loss) income from equity

investments and other ........ 1 (1) 243 (580) 472 2,217 (1,101) (255)

Minority interest ............. (3,647) (3,347) (4,269) (3,173) — — — —

Early retirement of debt . ........ — — — — (1,794) — — —

Income (loss) before income taxes . . 8,641 11,187 5,265 5,213 (56,275) 16,585 6,004 5,122

Income taxes . ............. (4,421) (6,676) (2,585) (2,512) 19,053 (7,520) (2,656) (2,566)

Net income (loss) ............. $ 4,220 $ 4,511 $ 2,680 $ 2,701 $ (37,222) $ 9,065 $ 3,348 $ 2,556

Net income (loss) per share:

Basic . .................. $ 0.15 $ 0.16 $ 0.10 $ 0.10 $ (1.34) $ 0.33 $ 0.12 $ 0.09

Diluted .................. $ 0.15 $ 0.16 $ 0.09 $ 0.10 $ (1.34) $ 0.32 $ 0.12 $ 0.09

(1) In the second quarter of 2008, we recognized $3.1 million in expense related to a proxy contest, the write-off of in-process acquisition costs

and a litigation settlement.

(2) In the first quarter of 2008, we acquired GroupEx and the majority ownership interest of Redbox.

(3) In the fourth quarter of 2007, we recorded an impairment and excess inventory charge.

(4) In the third quarter of 2007, we recognized a telecommunication fee refund. The net income effect of the refund, net of taxes, monies owed to

a joint venture and other effects was approximately $6.5 million in the third quarter of 2007.

42