Redbox 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

after January 1, 2003, from our employee equity compensation plans. As of December 31, 2008, this authorization

allows us to repurchase up to $23.9 million of our common stock.

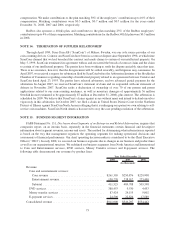

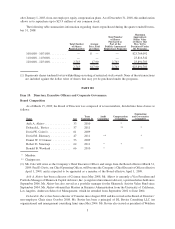

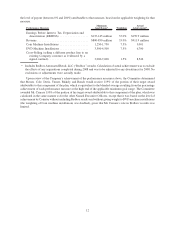

The following table summarizes information regarding shares repurchased during the quarter ended Decem-

ber 31, 2008:

Total Number

of Shares

Repurchased(1)

Average

Price Paid

per Share

Total Number

of Shares

Purchased as

Part of the

Publicly Announced

Repurchase Programs

Maximum

Approximate

Dollar Value

of Shares that

May Yet be

Purchased Under

the Programs

10/01/08 - 10/31/08 .......... — $ — — $23,764,092

11/01/08 - 11/30/08 .......... — — — 23,816,542

12/01/08 - 12/31/08 .......... 2,743 17.90 2,743 23,891,703

2,743 $17.90 2,743 $23,891,703

(1) Represents shares tendered for tax withholding on vesting of restricted stock awards. None of these transactions

are included against the dollar value of shares that may yet be purchased under the programs.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Board Composition

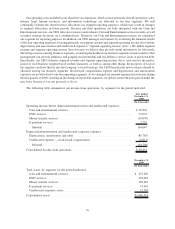

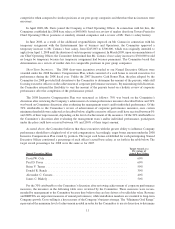

As of March 15, 2009, the Board of Directors was composed of seven members, divided into three classes as

follows:

Name Age

Term

Expiring In

Audit

Committee

Compensation

Committee

Nominating

and Governance

Committee

Arik A. Ahitov ................ 33 2010 *

Deborah L. Bevier ............. 57 2011 ** *

David W. Cole(1) .............. 61 2009

David M. Eskenazy ............ 47 2011 ** *

Daniel W. O’Connor............ 53 2009

Robert D. Sznewajs ............ 62 2011 * *

Ronald B. Woodard ............ 66 2010 * **

* Member.

** Chairperson.

(1) Mr. Cole will retire as the Company’s Chief Executive Officer and resign from the Board effective March 31,

2009. Paul D. Davis, our Chief Operating Officer, will become the Company’s Chief Executive Officer effective

April 1, 2009, and is expected to be appointed as a member of the Board effective April 1, 2009.

Arik A. Ahitov has been a director of Coinstar since May 2008. Mr. Ahitov is currently a Vice President and

Portfolio Manager of Shamrock Capital Advisors, Inc. (a registered investment advisor), a position he has held since

September 2006. Mr. Ahitov has also served as a portfolio manager for the Shamrock Activist Value Fund since

September 2004. Mr. Ahitov obtained his Masters in Business Administration from the University of California,

Los Angeles, Anderson School of Management, which he attended from September 2002 to June 2004.

Deborah L. Bevier has been a director of Coinstar since August 2002 and has served as the Board of Directors’

non-employee Chair since October 2008. Ms. Bevier has been a principal of DL Bevier Consulting LLC (an

organizational and management consulting firm) since May 2004. Ms. Bevier also served as president of Waldron

5