Redbox 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

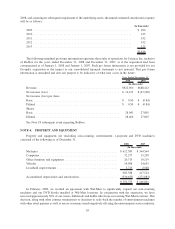

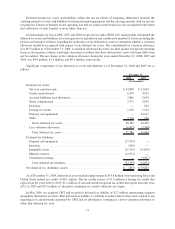

resulted in excess equipment and inventory. As a result, we recorded a non-cash impairment charge of $52.6 million

or approximately 50% of the net book value of our entertainment machines related to the impairment of these

cranes, bulk heads, and kiddie rides in the year ended December 31, 2007.

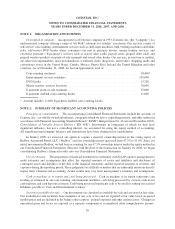

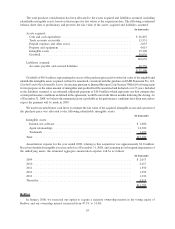

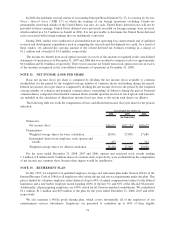

NOTE 5: INTANGIBLE ASSETS

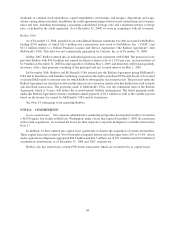

The gross carrying amounts and related accumulated amortization as well as the range of estimated useful lives

of identifiable intangible assets at the reported balance sheet dates were as follows:

Range of

Estimated

Useful Lives

(in years)

Estimated

Weighted

Average

Useful Lives

(in years)

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

2008 2007

(In thousands)

December 31,

Intangible assets:

Retailer and agent

relationships .......... 3-10 9.17 $57,661 $(23,287) $44,005 $(17,180)

Other identifiable intangible

assets................ 1-40 8.02 13,765 (4,754) 10,686 (3,054)

Total .................... $71,426 $(28,041) $54,691 $(20,234)

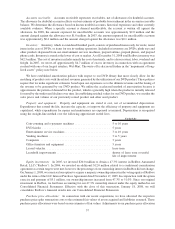

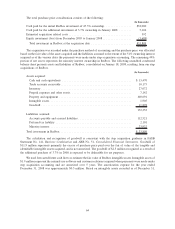

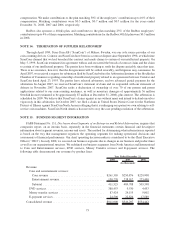

Based on identifiable intangible assets recorded as of December 31, 2008, and assuming no subsequent

impairment of the underlying assets, the annual estimated aggregate future amortization expenses are as follows:

(In thousands)

2009 ............................................................. $ 9,004

2010 ............................................................. 8,278

2011 ............................................................. 6,562

2012 ............................................................. 6,172

2013 ............................................................. 4,825

Thereafter ......................................................... 8,544

$43,385

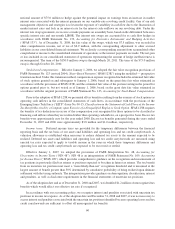

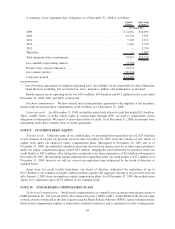

NOTE 6: ACCRUED LIABILITIES

Accrued liabilities consisted of the following as of December 31:

2008 2007

(In thousands)

Payroll related expenses ......................................... $25,460 $12,442

Interest payable ............................................... 2,268 616

Taxes payable ................................................. 16,758 4,068

Accrued rent .................................................. 12,981 —

Accrued professional fees ........................................ 3,697 1,659

Service contract providers ........................................ 5,031 5,451

Accrued medical insurance ....................................... 1,564 1,951

Payable to related party for telecommunication fee refund ................ — 5,547

Accrued acquisition costs ........................................ 10,000 —

Interest rate swap .............................................. 7,467 —

Other ....................................................... 12,261 9,177

$97,487 $40,911

66