Redbox 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

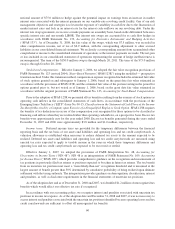

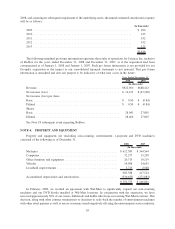

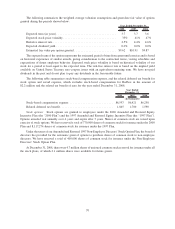

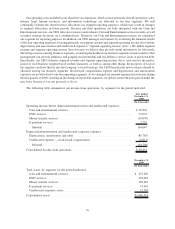

The following summarizes the weighted average valuation assumptions and grant date fair value of options

granted during the periods shown below:

2008 2007 2006

Year Ended December 31,

Expected term (in years) ..................................... 3.7 3.7 3.6

Expected stock price volatility................................. 35% 41% 47%

Risk-free interest rate ....................................... 2.5% 4.4% 4.6%

Expected dividend yield ..................................... 0.0% 0.0% 0.0%

Estimated fair value per option granted .......................... $9.62 $10.91 $9.87

The expected term of the options represents the estimated period of time from grant until exercise and is based

on historical experience of similar awards, giving consideration to the contractual terms, vesting schedules and

expectations of future employee behavior. Expected stock price volatility is based on historical volatility of our

stock for a period at least equal to the expected term. The risk-free interest rate is based on the implied yield

available on United States Treasury zero-coupon issues with an equivalent remaining term. We have not paid

dividends in the past and do not plan to pay any dividends in the foreseeable future.

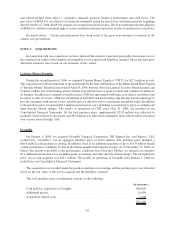

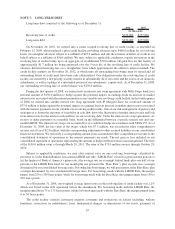

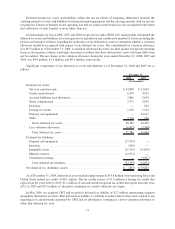

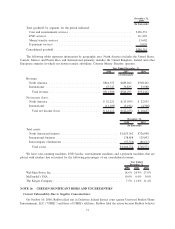

The following table summarizes stock-based compensation expense, and the related deferred tax benefit for

stock option and award expense, which excludes stock-based compensation for Redbox in the amount of

$2.2 million and the related tax benefit of zero for the year ended December 31, 2008:

2008 2007 2006

Year Ended

December 31,

(In thousands)

Stock-based compensation expense ........................... $6,597 $6,421 $6,258

Related deferred tax benefit ................................. 1,845 1,700 1,590

Stock options: Stock options are granted to employees under the 2000 Amended and Restated Equity

Incentive Plan (the “2000 Plan”) and the 1997 Amended and Restated Equity Incentive Plan (the “1997 Plan”).

Options awarded vest annually over 4 years and expire after 5 years. Shares of common stock are issued upon

exercise of stock options. We have reserved a total of 770,000 shares of common stock for issuance under the 2000

Plan and 8,117,274 shares of common stock for issuance under the 1997 Plan.

Under the terms of our Amended and Restated 1997 Non-Employee Directors’ Stock Option Plan, the board of

directors has provided for the automatic grant of options to purchase shares of common stock to non-employee

directors. We have reserved a total of 400,000 shares of common stock for issuance under the Non-Employee

Directors’ Stock Option Plan.

At December 31, 2008, there were 4.7 million shares of unissued common stock reserved for issuance under all

the stock plans, of which 2.1 million shares were available for future grants.

70