Redbox 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2008, we had five irrevocable standby letters of credit that totaled $12.4 million. These

standby letters of credit, which expire at various times through December 2009, are used to collateralize certain

obligations to third parties. Prior to and as of December 31, 2008, no amounts have been, or are outstanding under

these standby letters of credit.

We believe our existing cash, cash equivalents and amounts available to us under our credit facility will be

sufficient to fund our cash requirements and capital expenditure needs for at least the next 12 months. After that

time, the extent of additional financing needed, if any, will depend on the success of our business. If we significantly

increase installations beyond planned levels or if coin-counting machine volumes generated or entertainment

services machine plays are lower than historical levels, our cash needs may increase. Furthermore, our future capital

requirements will depend on a number of factors, including cash required by future acquisitions, consumer use of

our services, the timing and number of machine installations, the number of available installable machines, the type

and scope of service enhancements and the cost of developing potential new product and service offerings and

enhancements.

Redbox Debt

As of December 31, 2008, included in our Consolidated Financial Statements was debt associated with Redbox

totaling $35.0 million, of which $11.9 million was a promissory note owed to GAM and $23.1 million related to a

Rollout Purchase, License and Service Agreement (“the Rollout Agreement”) with McDonald’s USA. This debt

was not contractually guaranteed by Coinstar, Inc as of December 31, 2008.

In May 2007, Redbox entered into an individual promissory note agreement with GAM. The promissory note

provided Redbox with $10.0 million and carried an effective interest rate of 11.0% per year. Accrued interest of

$1.9 million at December 31, 2008 becomes payable to GAM on May 1, 2009, and thereafter, will be paid quarterly,

in arrears, with a final payment consisting of the principal and any accrued interest on May 1, 2010.

In November 2006, Redbox and McDonald’s USA entered into the Rollout Agreement giving McDonald’s

USA and its franchisees and franchise marketing cooperatives the right to purchase DVD rental kiosks to be located

at selected McDonald’s restaurant sites for which Redbox subsequently received proceeds. The proceeds under the

Rollout Agreement are classified as debt and the interest rate is based on similar rates that Redbox has with its kiosk

sale-leaseback transactions. The payments made to McDonald’s USA over the contractual term of the Rollout

Agreement, which is 5 years, will reduce the accrued interest liability and principal. The future payments made

under this Rollout Agreement contain a minimum annual payment of $2.1 million as well as the variable payouts

based on the license fee earned by McDonald’s USA and its franchisees.

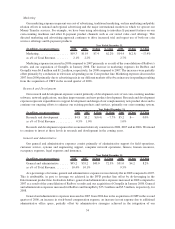

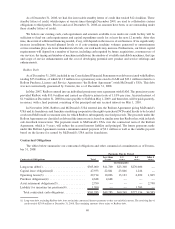

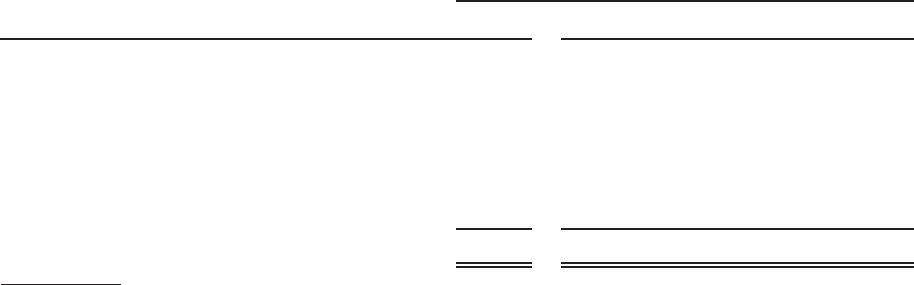

Contractual Obligations

The tables below summarize our contractual obligations and other commercial commitments as of Decem-

ber 31, 2008:

Contractual Obligations Total

Less than

1 year

1-3

years

4-5

years

After 5

years

Payments Due by Period

(In thousands)

Long-term debt(1) .......................... $305,000 $11,700 $23,300 $270,000 —

Capital lease obligations(2) ................... 47,933 22,841 23,846 1,246 —

Operating leases(3) ......................... 29,714 10,096 13,123 4,690 1,805

Purchase obligations(4) ...................... 4,648 4,648 — — —

Asset retirement obligations(5) ................. 2,790 — — — 2,790

Liability for uncertain tax positions(6) ........... 1,200 — — 1,200 —

Total contractual cash obligations . . ........... $391,285 $49,285 $60,269 $277,136 $4,595

(1) Long-term debt, excluding Redbox debt, does not include contractual interest payments as they are variable in nature. The revolving line of

credit totaled $270.0 million at December 31, 2008. The remaining amounts above relate to Redbox debt.

40