Redbox 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

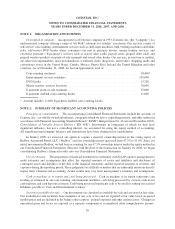

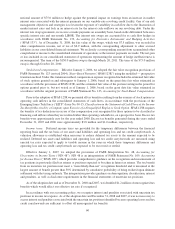

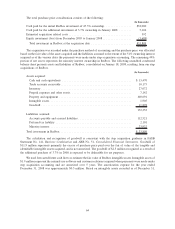

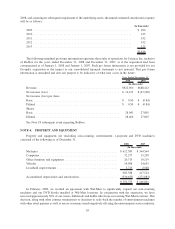

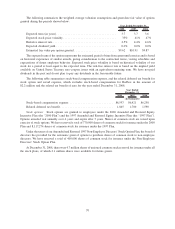

The total purchase price consideration consists of the following:

(In thousands)

Cash paid for the initial Redbox investment of 47.3% ownership ................. $32,000

Cash paid for the additional investment of 3.7% ownership in January 2008 ........ 5,106

Estimated acquisition related costs ....................................... 392

Equity investment (loss) from December 2005 to January 2008 .................. (3,689)

Total investment in Redbox at the acquisition date ......................... $33,809

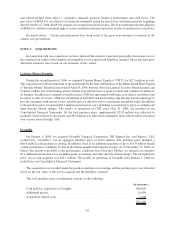

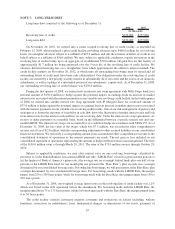

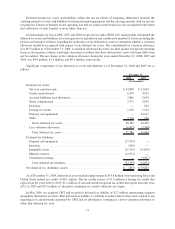

The acquisition was recorded under the purchase method of accounting and the purchase price was allocated

based on the fair value of the assets acquired and the liabilities assumed to the extent of the 51% ownership interest

acquired as of the various dates the payments were made under step acquisition accounting. The remaining 49%

portion of net assets represents the minority interest ownership in Redbox. The following unaudited condensed

balance sheet presents assets and liabilities of Redbox, consolidated on January 18, 2008, resulting from our step

acquisitions of Redbox.

(In thousands)

Assets acquired:

Cash and cash equivalents . . . ........................................ $ 13,470

Trade accounts receivable ............................................ 10,175

Inventory ........................................................ 27,072

Prepaid expenses and other assets ...................................... 7,142

Property and equipment ............................................. 100,691

Intangible assets ................................................... 1,905

Goodwill ........................................................ 11,898

172,353

Liabilities assumed:

Accounts payable and accrued liabilities ................................. 112,521

Deferred tax liability ............................................... 2,101

Minority interest .................................................. 23,922

Total investment in Redbox ............................................ $ 33,809

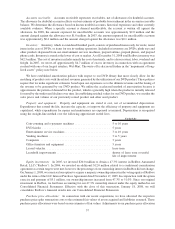

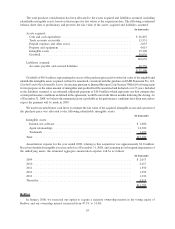

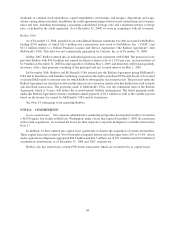

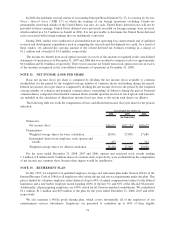

The calculation and recognition of goodwill is consistent with the step acquisition guidance in FASB

Statement No. 141, Business Combination and ARB No. 51, Consolidated Financial Statements. Goodwill of

$11.9 million represents primarily the excess of purchase price paid over the fair of value of the tangible and

identifiable intangible assets acquired, and is not amortized. The goodwill of $2.5 million recognized as a result of

the additional purchase of 3.7% in 2008 is expected to be deductible for tax purposes.

We used forecasted future cash flows to estimate the fair value of Redbox intangible assets. Intangible assets of

$1.9 million represent the internal-use software and customer relations acquired when payments were made under

step acquisition accounting and are amortized over 5 years. The amortization expense for the year ended

December 31, 2008 was approximately $0.5 million. Based on intangible assets recorded as of December 31,

64