Redbox 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

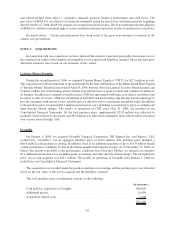

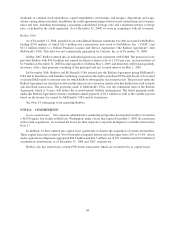

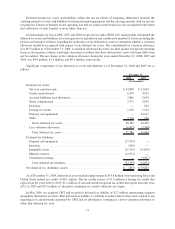

2008, and assuming no subsequent impairment of the underlying assets, the annual estimated amortization expense

will be as follows:

(In thousands)

2009 ............................................................. $ 496

2010 ............................................................. 415

2011 ............................................................. 192

2012 ............................................................. 192

2013 ............................................................. 121

$1,416

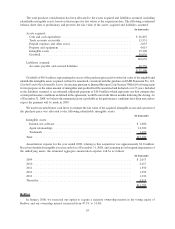

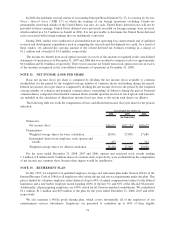

The following unaudited pro forma information represents the results of operations for Coinstar, Inc. inclusive

of Redbox for the years ended December 31, 2008 and December 31, 2007, as if the acquisition had been

consummated as of January 1, 2008 and January 1, 2007. Such pro forma information is not provided for our

GroupEx acquisition as the impact to our consolidated financial statements is not material. This pro forma

information is unaudited and does not purport to be indicative of what may occur in the future:

2008 2007

Year Ended December 31,

(In thousands)

Revenue ................................................... $922,910 $680,412

Net income (loss) ............................................ $ 14,123 $ (23,348)

Net income (loss) per share

Basic ..................................................... $ 0.50 $ (0.84)

Diluted .................................................... $ 0.50 $ (0.84)

Shares:

Basic ..................................................... 28,041 27,805

Diluted .................................................... 28,464 27,805

See Note 18 subsequent event regarding Redbox.

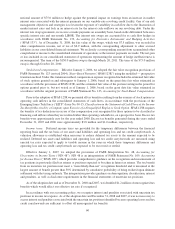

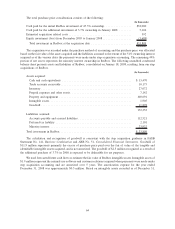

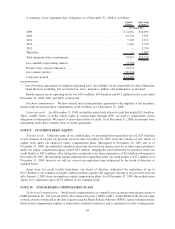

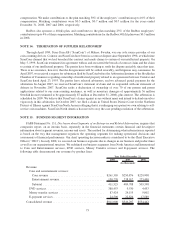

NOTE 4: PROPERTY AND EQUIPMENT

Property and equipment, net (including coin-counting, entertainment, e-payment and DVD machines)

consisted of the following as of December 31:

2008 2007

(In thousands)

Machines ................................................. $612,583 $ 364,564

Computers ................................................ 32,277 15,238

Office furniture and equipment ................................. 20,715 10,119

Vehicles .................................................. 14,098 24,655

Leasehold improvements . . . ................................... 3,715 2,548

683,388 417,124

Accumulated depreciation and amortization ........................ (330,635) (271,083)

$ 352,753 $ 146,041

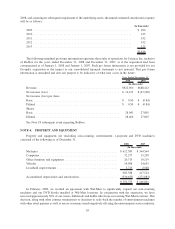

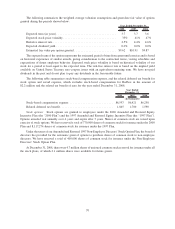

In February 2008, we reached an agreement with Wal-Mart to significantly expand our coin-counting

machines and our DVD kiosks installed at Wal-Mart locations. In conjunction with the expansion, we have

removed approximately 50% of our cranes, bulk heads and kiddie rides from our existing Wal-Mart locations. This

decision, along with other contract terminations or decisions to scale-back the number of entertainment machines

with other retail partners as well as macro-economic trends negatively affecting the entertainment service industry,

65