Redbox 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.that new distribution terms proposed by USHE would prohibit Redbox from renting Universal Studios DVDs for

45 days after their public release, would limit how many Universal Studios DVDs each Redbox kiosk could carry,

and would require Redbox to destroy, rather than sell at a discount, previously-viewed DVDs from its kiosks.

Redbox asserts that USHE’s conduct violates antitrust laws, constitutes copyright abuse, and tortiously interferes

with contracts between Redbox and its DVD suppliers. On December 5, 2008, USHE and its co-defendants moved

to dismiss the complaint. As of December 31, 2008, the lawsuit was still in the preliminary pleading stages with no

substantive rulings by the court.

We currently conduct limited manufacturing operations and obtain key hardware components used in our coin-

counting and entertainment services machines from a limited number of suppliers. Although we use a limited

number of suppliers, we believe that other suppliers could provide similar equipment, which may require certain

modifications or may have a longer lead time from order date. Accordingly, a change in suppliers could cause a

delay in manufacturing and a possible slow-down of growth, which could have a materially adverse affect on future

operating results.

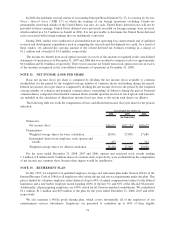

NOTE 17: RELATED PARTY AND OTHER TRANSACTIONS

As of December 31, 2007 and 2006, approximately $219,000 and $448,000, respectively, of our accounts

receivable balance is due from a related party of our e-payment subsidiary. This receivable arose in the ordinary

course of business and relates to the purchase of prepaid air time. In addition, approximately $5.5 million of our

other accrued liabilities balance at December 31, 2007 is our best estimate of the amount due to a related party of our

e-payment subsidiary relating to the amount that was refunded to us on their behalf relating to a telecommunication

fee refund as a result of an Internal Revenue Service ruling that telecommunication fees paid during the period of

March 1, 2003 through July 31, 2006 were improperly collected by the United States government. In the third

quarter of 2007, we have recognized $2.7 million of income from equity investments, or 49% of the $5.5 million

payable, related to our equity interest in the third party. We received this refund in the amount estimated in February

2008.

During the third quarter of 2007, direct operating expenses in our income statement included a telecommu-

nication fee refund in the amount of $11.8 million as a result of an Internal Revenue Service ruling that

telecommunication fees paid during the period of March 1, 2003 through July 31, 2006 were improperly collected

by the United States government. The $11.8 million represents the refund amount as filed on our fiscal year 2006

federal income tax return. This telecommunication fee refund, along with the $5.5 million amount received by us on

behalf of our equity investment related party and accrued interest, totaling of $17.6 million is included in accounts

receivable, net as of December 31, 2007. In February 2008, we received the refund in the amount that we estimated.

In the second quarter of 2008 we settled a proxy contest which resulted in one additional member to our Board

of Directors, and one additional independent director to be added by March 1, 2009. Expenses related to this proxy

contest, including the solicitation of stockholders, were approximately $4.1 million. We also incurred expenses

associated with the write-off of in-process acquisition expenses of $1.0 million for due diligence and professional

service costs in connection with acquisitions that were being considered in the past and for which discussions have

now been terminated.

During the second quarter of 2008, we entered into a settlement agreement with Incomm Holding, Inc. and

certain of its affiliates (“Incomm”). As a result, we and Incomm have agreed to dissolve a related party of our

E-payment subsidiary of which we own 49%. A previous liability owed to the related party was relieved. The net

settlement, after attorney fees, was approximately $2.0 million of income.

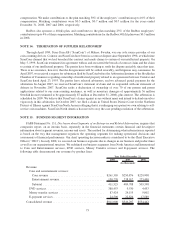

NOTE 18: SUBSEQUENT EVENTS

Acquisition of Redbox: On February 12, 2009, we entered into a Purchase and Sale Agreement (the “GAM

Purchase Agreement”) with GetAMovie Inc. (“GAM”), pursuant to which we agreed to acquire (i) GAM’s 44.4%

voting interests (the “Interests”) in Redbox and (ii) GAM’s right, title and interest in a Term Promissory Note dated

May 3, 2007 made by Redbox in favor of GAM in the principal amount of $10.0 million (the “Note”), in exchange

for a combination of cash and our common stock, par value $0.001 per share (the “Common Stock”).

78