Redbox 2008 Annual Report Download - page 90

Download and view the complete annual report

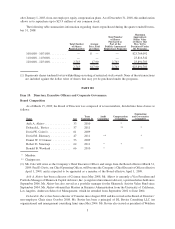

Please find page 90 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.withholding obligations for a restricted stock award. In addition, Ronald B. Woodard filed a late Form 4 in 2009

with respect to a purchase of shares that occurred in a prior year.

Code of Conduct and Code of Ethics

Coinstar’s Board of Directors has adopted a Code of Ethics that applies to its Chief Executive Officer, Chief

Financial Officer, principal accounting officer, and controller (or persons performing similar functions) and a Code

of Conduct that applies to all directors, officers, and employees of the Company. A copy of each is available on the

Investor Relations section of Coinstar’s website at www.coinstar.com. Material amendments to and waivers from

either, if any, will be disclosed on the Investor Relations section of Coinstar’s website.

Audit Committee

The Board of Directors has established a standing Audit Committee. Membership of the Audit Committee is

determined annually by the Board of Directors. Adjustments to committee assignments may be made at any time.

As of March 15, 2009, membership of the Audit Committee was as set forth above under “Board Composition.”

The Board of Directors has determined that each member of the Audit Committee meets the independence and

financial literacy requirements of the SEC and Nasdaq and that Mr. Grinstein was independent during his service on

the Board. The Board has also determined that Messrs. Eskenazy and Sznewajs are “audit committee financial

experts” under SEC rules, have accounting or related financial management experience, and are financially

sophisticated under the Nasdaq Marketplace Rules.

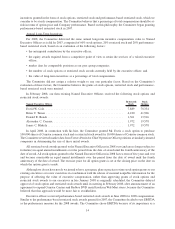

Item 11. Executive Compensation.

COMPENSATION DISCUSSION AND ANALYSIS

Objectives of Compensation Programs

Compensation Philosophy and Policies

Our executive compensation programs are designed to attract, motivate, and retain executive officers critical to

our long-term success and the creation of stockholder value. The decisions by the Compensation Committee of the

Board (for purposes of the Compensation Discussion and Analysis, the “Committee”) concerning the specific

compensation elements and total compensation paid or awarded to our executive officers for 2008 were made with

the intent that executive compensation:

• remain aligned with the goal of enhancing stockholder value; and

• reflect evolving compensation standards and practices among our peer group companies (described below).

The Committee believes that the allocation among the different forms of compensation should vary based on

the position and level of responsibility. For example, those executives with the greater ability to influence Company

performance will have a higher level of at-risk compensation in the form of an increased percentage of total

compensation in stock options, restricted stock awards, performance-based restricted stock and performance-based

short-term incentives. The lower the level of influence of an executive on Company performance, the higher the

percentage of their total compensation is in the form of base salary with a correspondingly lower percentage of stock

options, restricted stock awards, performance-based restricted stock and performance-based short-term incentives.

Accordingly, the Committee designs executive compensation for higher-level executives to align closely with

stockholders’ and our long-term shared interests.

Particular factors affecting the Committee’s decisions for 2008 included:

•“total” compensation — the Committee believes executive compensation packages should take into

account the competitiveness of each component of compensation, but also total compensation, which

includes: base salary, short-term (cash) and long-term (equity) incentives and benefits;

8