Redbox 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

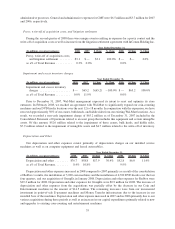

(2) Capital lease obligations represent gross minimum lease payments, which includes interest.

(3) One of our lease agreements is a triple net operating lease. We are responsible for obligations including, but not limited to, taxes, insurance,

utilities and maintenance as incurred. These obligations are not reported in the amounts above.

(4) Purchase obligations consist of outstanding purchase orders issued in the ordinary course of our business.

(5) Asset retirement obligations represent the fair value of a liability related to the machine removal costs following contract expiration.

(6) Liability for uncertain tax positions represents amounts that we are contingently liable for based on our tax positions with their respective

statute of limitations ending within 4 to 5 years.

Other Commercial Commitments Total

Less than

1 year

1-3

years

4-5

years

After 5

years

Amount of Commitment Expiration by Period

(In thousands)

Letters of credit ................................... $12,406 $12,406 — — —

Total commercial commitments ...................... $12,406 $12,406 $— $— $—

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of

our credit agreement with a syndicate of lenders led by Bank of America, N.A. and investment activities that

generally bear interest at variable rates. Because our investments have maturities of three months or less, and our

credit facility interest rates are based upon either the LIBOR, prime rate or base rate plus an applicable margin, we

believe that the risk of material loss is low and that the carrying amount of these balances approximates fair value.

Based on our outstanding revolving line of credit obligations of $270.0 million as of December 31, 2008, an

increase of 1.0% in interest rates over the next year would increase our annualized interest expense by approx-

imately $0.4 million, net of a $2.3 million offset resulting from our interest rate swap agreements; a decrease of

1.0% in interest rates over the next year would decrease our annualized interest expense by approximately

$0.4 million, net of a $2.3 million offset resulting from our interest rate swap agreements. Such potential increases

or decreases are based on certain simplified assumptions, including an immediate, across-the-board increase or

decrease in the level of interest rates with no other subsequent changes for the remainder of the periods. In 2008, we

have hedged a portion of our interest rate risk by entering into two interest rate swaps with notional amounts of

$150.0 million and $75.0 million, respectively. The interest rate swaps convert a portion of our variable one-month

LIBOR rate financing into a fixed interest rate financing. These fixed interest rate swaps reduce the effect of

fluctuations in the market interest rates. The term of the $150.0 million swap is through March 20, 2011. The term of

the $75.0 million swap is through October 28, 2010.

We are further subject to the risk of foreign exchange rate fluctuation in the normal course of business as a

result of our operations in the United Kingdom, Ireland, Europe, Canada and Mexico.

Item 8. Financial Statements and Supplementary Data.

See Item 15 for an index to the financial statements and supplementary data required by this item, which are

included as a separate section on page 44 and which are incorporated herein by reference.

41