Redbox 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

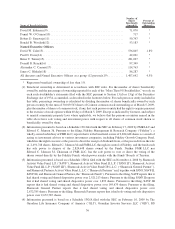

(4) Calculated by multiplying the number of shares subject to accelerated options by $19.51 (the closing price of

the Company’s common stock on December 31, 2008) less the exercise price of the stock option grant. For

purposes of the amounts reflected in the table, we have assumed that the plan administrator elected to accelerate

the vesting of options and/or that the surviving company refused to assume or substitute the awards.

(5) Amount reflects the payment of COBRA premiums for 12 months following termination.

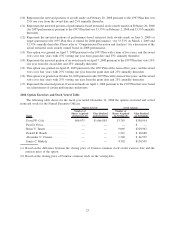

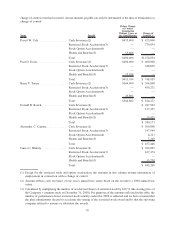

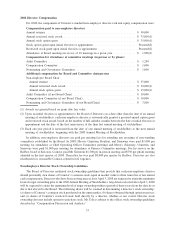

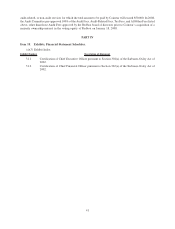

2008 Director Compensation Table

The following table shows compensation earned by or paid to our non-employee directors who served as

directors during 2008.

Name(1)

Fees Earned or

Paid in Cash

Stock

Awards(2)

Option

Awards(3)

All Other

Compensation Total

Arik A. Ahitov(4) . ..................... $40,500 $ 42,453 $19,850 — $102,803

Deborah L. Bevier(5) ................... 88,250(6) 75,330 34,708 — 198,288

David M. Eskenazy .................... 76,500 75,330 34,708 — 186,538

Keith D. Grinstein ..................... 92,750(6) 46,031 21,186 $19,750(7) 179,717

R. Michael Rouleau(8) .................. 32,000(6) 107,874 49,925 — 189,799

Robert D. Sznewajs .................... 78,500 75,330 34,708 — 188,538

Ronald B. Woodard .................... 70,000 75,330 34,708 — 180,038

(1) David W. Cole, as Chief Executive Officer, did not receive additional compensation for his services on the

Company’s Board of Directors. Mr. Cole’s compensation is described in the 2008 Summary Compensation

Table.

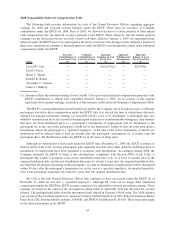

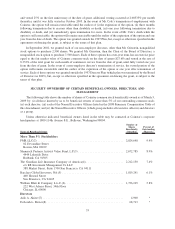

(2) As of December 31, 2008, non-employee members of the Board of Directors had the following aggregate

number of restricted stock awards outstanding: Mr. Ahitov, 2,033; Ms. Bevier, 2,033; Mr. Eskenazy, 2,033;

Mr. Sznewajs, 2,033; and Mr. Woodard, 2,033. The dollar amounts in this column reflect the amount recognized

for financial statement reporting purposes in accordance with FAS 123R (excluding the accounting effect of any

estimate of future forfeitures, and reflecting the effect of any actual forfeitures) for the fiscal year ended

December 31, 2008. Accordingly, the amounts include amounts from awards granted in or prior to 2008.

Assumptions used in the calculation of these amounts are described in notes 2 and 10 to the Company’s audited

financial statements included in the Form 10-K. On June 3, 2008, each non-employee director received an

annual award of restricted stock with a grant date fair value of $75,000, based on the closing price of our

common stock on the date of grant ($36.89), resulting in 2,033 shares of restricted stock. As Chair of the Board

of Directors, Mr. Grinstein received an additional award of restricted stock with a grant date fair value of

$30,000, based on the closing price of our common stock on the date of grant ($36.89), resulting in 813 shares of

restricted stock. Each restricted stock award vests one year from the date of grant and, if unvested, is forfeited

upon a director’s termination of service. The FAS 123R value of the restricted stock awards forfeited by

Mr. Grinstein in 2008 was $30,395.

(3) As of December 31, 2008, non-employee members of the Board of Directors had the following aggregate

number of stock options outstanding: Mr. Ahitov, 3,128; Ms. Bevier, 55,562; Mr. Eskenazy, 65,562;

Mr. Sznewajs, 39,562; and Mr. Woodard, 44,562. In addition, although they were no longer serving as

directors as of December 31, 2008, Mr. Grinstein had 84,808 options and Mr. Rouleau had 17,062 options

outstanding as of such date. The dollar amounts in this column reflect the amount recognized for financial

statement reporting purposes in accordance with FAS 123R (excluding the accounting effect of any estimate of

future forfeitures, and reflecting the effect of any actual forfeitures) for the fiscal year ended December 31,

2008. Accordingly, the amounts include amounts from options granted in or prior to 2008. Assumptions used in

the calculation of these amounts are described in notes 2 and 10 to the Company’s audited financial statements

included in the Form 10-K. On June 3, 2008, each non-employee director received an annual stock option grant

with a grant date fair value of $35,000, resulting in an option to purchase 3,128 shares of common stock. As

Chair of the Board of Directors, Mr. Grinstein received an additional stock option grant with a grant date fair

value of $15,000, resulting in an option to purchase 1,340 shares of common stock. These grants vest in equal

31