Redbox 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•“pay-for-performance” — the Committee believes a significant portion of executive compensation should

be determined based on Company and line of business results as compared to quantitative and qualitative

performance goals set at the beginning of each year to ensure accountability and motivate executives to

achieve a higher level of performance;

•“at-market” compensation — the Committee believes executive compensation levels should generally be at

or above the median compensation awarded to similarly situated peer group companies in order to attract and

retain the most qualified candidates;

•“stockholder aligned” compensation — the Committee believes equity compensation awarded to executive

officers (consisting of a mix of stock options, restricted stock awards and performance-based restricted

stock) should be a significant portion of each executive’s compensation and should further the shared

interests of our executives and stockholders;

•“fair” compensation — the Committee believes executive compensation levels should be perceived as fair,

both internally and externally; and

•“tax deductible” compensation — the Committee believes we should maximize the tax deductibility of

compensation paid to executive officers, as permitted under Section 162(m) of the Internal Revenue Code of

1986, as amended (the “Code”); but may approve components of executive compensation that will not meet

the requirements of Section 162(m) in order attract, motivate, and retain executives.

The compensation philosophy and policies for 2008 were established based on discussion among the

Committee, management, and outside consultants. The Committee reviews the compensation philosophy and

policies annually when determining the next year’s executive compensation.

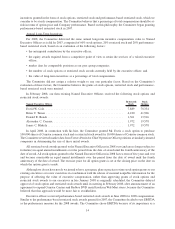

Benchmarking of Compensation

In order to attract and retain the most qualified candidates and depending on the executive’s position and/or the

component of compensation, the Committee’s intent is to generally set the components of executive compensation

(base salary, short-term incentives and long-term incentives) at the median or above the median but below the

75th percentile of compensation awarded to similarly situated peer group companies. The Committee reviews

survey data/market studies in order to generally determine competitive market pay and market/industry trends in

executive compensation.

For 2008 executive compensation, the Committee retained Towers Perrin as a compensation consultant to

conduct a total direct compensation analysis for the Chief Executive Officer, Chief Financial Officer and Chief

Operating Officer, and to make recommendations for changes based on Coinstar’s pay philosophy, business

objectives and stockholder expectations. For all other executives, the Committee did not rely on a new market

analysis but instead aged the data used for determination of 2007 compensation by 3.5% to reflect inflation. Towers

Perrin conducted a competitive market analysis of the three executive positions which included published national

survey sources of similarly sized companies augmented by proxy data of predominantly West Coast companies of

similar size with price to earnings multiples similar to the Company’s. For the 2008 analysis, three new peer

companies were added to the proxy data analysis (Bally Technologies, Inc., Euronet Worldwide, Inc. and WMS

Industries Inc.) and four companies that were in the peer group for 2007 were excluded (Esterline Technologies,

Inc., Keystone Automotive Industries, Inc., MacDermid, Incorporated and Mentor Graphics Corporation).

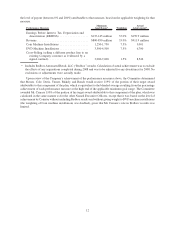

The data gathered included 25th percentile, 50th percentile (median) and 75th percentile base salary and actual

cash compensation levels as well as 50th percentile and 75th percentile long-term incentive and total direct

compensation levels. Specifically, Towers Perrin provided data from the 2007 Mercer Executive Compensation

Survey Report (for companies with $500 million to $1 billion in revenues), the 2007/2008 Watson Wyatt Survey

9