Redbox 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

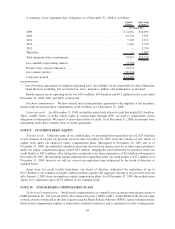

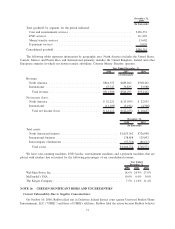

compensation. We make contributions to the plan matching 50% of the employees’ contribution up to 10% of their

compensation. Matching contributions were $0.5 million, $0.7 million and $0.7 million for the years ended

December 31, 2008, 2007 and 2006, respectively.

Redbox also sponsors a 401(k) plan, and contributes to the plan matching 25% of the Redbox employees’

contributions up to 4% of their compensation. Matching contributions for the Redbox 401(k) plan were $0.3 million

in 2008.

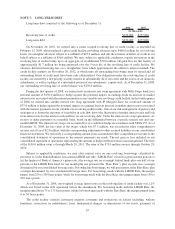

NOTE 14: TERMINATION OF SUPPLIER RELATIONSHIP

Through April 1999, Scan Coin AB (“ScanCoin”) of Malmo, Sweden, was our sole source provider of our

coin-counting devices. Coinstar and ScanCoin have been in a contract dispute since September 1998, at which time

ScanCoin claimed that we had breached the contract and made claims to certain of our intellectual property. On

May 5, 1999, ScanCoin terminated its agreement with us and reasserted the breach of contract claim and the claim

to certain of our intellectual property. The parties have been working to settle the dispute amicably since that time.

There is no assurance, however, that the disagreement will be settled amicably, and litigation may commence. In

April 2007, we received a request for arbitration filed by ScanCoin before the Arbitration Institute of the Stockholm

Chamber of Commerce regarding ownership of intellectual property related to an agreement between Coinstar and

ScanCoin dated April 23, 1993. The parties have selected arbitrators, and we advanced partial payment for the

arbitration. In August 2007, we received ScanCoin’s statement of claim and we responded with our statement of

defense in November 2007. ScanCoin seeks a declaration of ownership of over 70 of our patents and patent

applications related to our coin-counting machines, as well as monetary damages of approximately 56 million

Swedish kronor (estimated to be approximately $7 million at December 31, 2008), plus interest. The arbitration is

scheduled for 2009. We believe that ScanCoin’s claims against us are without merit and intend to defend ourselves

vigorously in this arbitration. In October 2007, we filed a claim in United States District Court for the Northern

District of Illinois against ScanCoin North America alleging that it is infringing on a patent we own relating to self-

service coin machines. ScanCoin North America has moved to stay the case pending resolution of the arbitration.

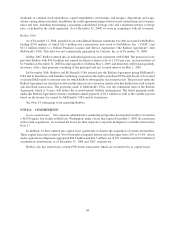

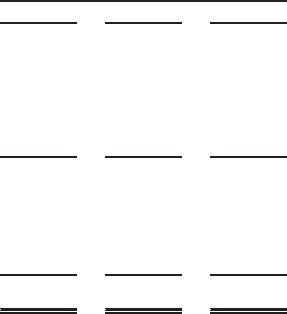

NOTE 15: BUSINESS SEGMENT INFORMATION

FASB Statement No. 131, Disclosure about Segments of an Enterprise and Related Information, requires that

companies report, on an interim basis, separately in the financial statements certain financial and descriptive

information about segment revenues, income and assets. The method for determining what information is reported

is based on the way that management organizes the operating segments for making operational decisions and

assessments of financial performance. Our chief operating decision maker is considered to be the Chief Executive

Officer (“CEO”). In early 2008, we assessed our business segments due to changes in our business and product lines

as well as our organizational structure. We redefined our business segments from North America and International

to Coin and Entertainment services, DVD services, Money Transfer services and E-payment services. The

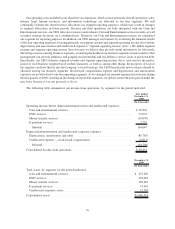

following table demonstrated our revenues by product lines:

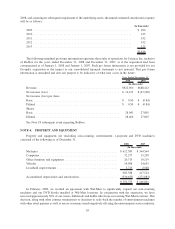

2008 2007 2006

Year Ended December 31,

(In thousands)

Revenue:

Coin and entertainment services:

Coin revenue .................................. $261,303 $250,876 $229,908

Entertainment revenue............................ 150,220 238,912 273,490

Subtotal ...................................... 411,523 489,788 503,398

DVD services .................................... 388,453 9,530 4,453

Money transfer services ............................ 87,424 24,155 9,002

E-payment services................................ 24,500 22,824 17,589

Consolidated revenue ................................ $911,900 $546,297 $534,442

75