Redbox 2008 Annual Report Download - page 70

Download and view the complete annual report

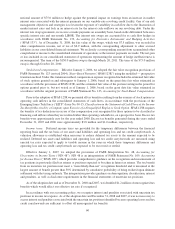

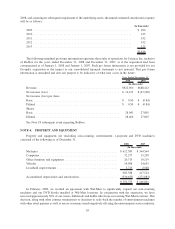

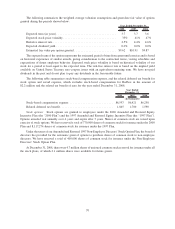

Please find page 70 of the 2008 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.dividends or common stock repurchases, capital expenditures, investments, and mergers, dispositions and acqui-

sitions, among other restrictions. In addition, the credit agreement requires that we meet certain financial covenants,

ratios and tests, including maintaining a maximum consolidated leverage ratio and a minimum interest coverage

ratio, as defined in the credit agreement. As of December 31, 2008, we were in compliance with all covenants.

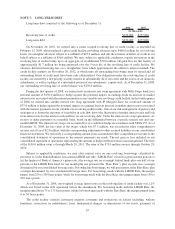

Redbox Debt

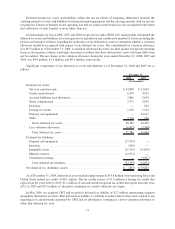

As of December 31, 2008, included in our consolidated financial statements was debt associated with Redbox

totaling $35.0 million, of which $11.9 million was a promissory note owed to GetAMovie, Inc. (“GAM”) and

$23.1 million related to a Rollout Purchase, License and Service Agreement (“the Rollout Agreement”) with

McDonald’s USA. This debt was not contractually guaranteed by Coinstar, Inc as of December 31, 2008.

In May 2007, Redbox entered into an individual promissory note agreement with GAM. The promissory note

provided Redbox with $10.0 million and carried an effective interest rate of 11.0% per year. Accrued interest of

$1.9 million at December 31, 2008 becomes payable to GAM on May 1, 2009, and thereafter, will be paid quarterly,

in arrears, with a final payment consisting of the principal and any accrued interest on May 1, 2010.

In November 2006, Redbox and McDonald’s USA entered into the Rollout Agreement giving McDonald’s

USA and its franchisees and franchise marketing cooperatives the right to purchase DVD rental kiosks to be located

at selected McDonald’s restaurant sites for which Redbox subsequently received proceeds. The proceeds under the

Rollout Agreement are classified as debt and the interest rate is based on similar rates that Redbox has with its kiosk

sale-leaseback transactions. The payments made to McDonald’s USA over the contractual term of the Rollout

Agreement, which is 5 years, will reduce the accrued interest liability and principal. The future payments made

under this Rollout Agreement contain a minimum annual payment of $2.1 million as well as the variable payouts

based on the license fee earned by McDonald’s USA and its franchisees.

See Note 18 subsequent event regarding Redbox.

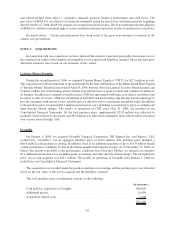

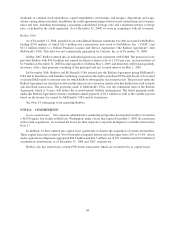

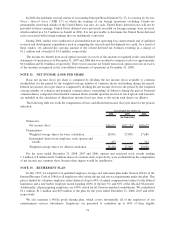

NOTE 8: COMMITMENTS

Lease commitments: Our corporate administrative, marketing and product development facility is located in

a 46,070 square foot facility in Bellevue, Washington, under a lease that expires December 1, 2009. In connection

with certain acquisitions, we assumed the leases for their respective corporate headquarters as further discussed in

Note 17.

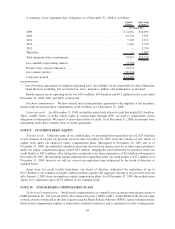

In addition, we have entered into capital lease agreements to finance the acquisition of certain automobiles.

These capital leases have terms of 36 to 60 months at imputed interest rates that range from 2.0% to 15.0%. Assets

under capital lease obligations aggregated $84.5 million and $24.5 million, net of $31.0 million and $10.0 million of

accumulated amortization, as of December 31, 2008 and 2007, respectively.

Redbox also has entered into certain DVD kiosk transactions which are accounted for as capital leases.

68