NetSpend 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

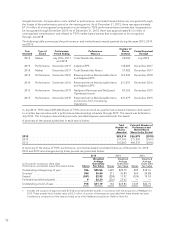

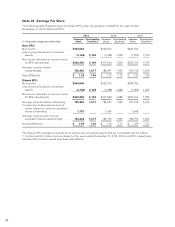

Pro Forma Results of Operations

The amounts of NetSpend revenue and earnings included in TSYS’ consolidated income statement for the year

ended December 31, 2013, and the pro forma revenue and earnings of the combined entity had the acquisition

date been January 1, 2013 are:

Actual Supplemental pro

forma

Year Ended

December 31 ,2013 Year Ended

December 31, 2013

(in thousands, except per share data)

Revenue .................................................... $2,064,305 2,286,348

Net income attributable to TSYS common shareholders ............ $ 244,750 239,775

Basic EPS attributable to TSYS common shareholders .............. $ 1.30 1.28

Diluted EPS attributable to TSYS common shareholders ............ $ 1.29 1.27

The unaudited pro forma financial information presented above does not purport to represent what the actual

results of operations would have been if the acquisition of NetSpend’s operations had occurred prior to

January 1, 2013, nor is it indicative of the future operating results of TSYS. The unaudited pro forma financial

information does not reflect the impact of future events that may occur after the acquisition, including, but not

limited to, anticipated cost savings from operating synergies.

The unaudited pro forma financial information presented in the table above has been adjusted to give effect to

adjustments that are (1) directly related to the business combination; (2) factually supportable; and (3) expected

to have a continuing impact. These adjustments include, but are not limited to, the application of accounting

policies; and depreciation and amortization related to fair value adjustments to property, plant and equipment

and intangible assets.

The pro forma adjustments do not reflect the following material items that result directly from the acquisition and

which impacted the statement of operations following the acquisition:

• Acquisition and related financing transactions costs relating to fees to investment bankers, attorneys,

accountants, and other professional advisors, and other transaction-related costs that were not capitalized as

deferred financing costs; and

• The effect of anticipated cost savings or operating efficiencies expected to be realized and related

restructuring charges such as technology and infrastructure integration expenses, and other costs related to

the integration of NetSpend into TSYS.

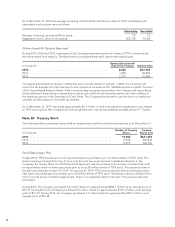

Redeemable Noncontrolling Interest

The fair value of the noncontrolling interest in CPAY, owned by a private company, was based on the actual

purchase price paid for the controlling interest in CPAY. Next, adjustments were made for lack of control and lack

of marketability that market participants would consider when estimating the fair value of the noncontrolling,

non-marketable interest in CPAY.

In connection with the acquisition of CPAY, the Company is party to call and put arrangements with respect to

the membership units that represent the remaining noncontrolling interest of CPAY. The call arrangement is

exercisable by TSYS and the put arrangement is exercisable by the Seller. The put arrangement is outside the

control of the Company by requiring the Company to purchase the Seller’s entire equity interest in CPAY at a put

price at fair market value. At the time of the original acquisition, the redemption of the put option was

considered probable based upon the passage of time of the second anniversary date. The put arrangement is

recorded on the balance sheet and is classified as redeemable noncontrolling interest outside of permanent

equity.

86