NetSpend 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recent Accounting Pronouncements

In November 2015, the Financial Accounting Standards Board (FASB) issued ASU 2015-17 “Income Taxes (Topic

740), Balance Sheet Classification of Deferred Taxes,” which requires the classification of all deferred tax assets

and liabilities as noncurrent on the balance sheet instead of separating deferred taxes into current and

noncurrent amounts. Also, companies will no longer allocate valuation allowances between current and

noncurrent deferred tax assets because those allowances also will be classified as noncurrent. The guidance is

effective for public business entities for annual and interim periods in fiscal years beginning after December 15,

2016. Early adoption is permitted. Companies can adopt the guidance either prospectively or retrospectively.

The Company does not expect the adoption of this ASU to have a material impact on the Company’s financial

position, results of operations or cash flows.

In April 2015, the FASB issued ASU 2015-03 “Interest — Imputation of Interest (Subtopic 835-30), Simplifying the

Presentation of Debt Issuance Cost.” The amendments in this update will require entities to present debt

issuance costs in the balance sheet as a direct deduction from the carrying amount of the corresponding debt

liability, consistent with debt discounts. The guidance is effective for annual periods and interim periods within

those annual periods beginning after December 15, 2015. Early adoption is permitted. The guidance will be

applied retrospectively. The Company does not expect the adoption of this guidance to have a material impact

on the Company’s financial position, results of operations or cash flows.

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers,” which requires an entity

to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or

services to customers. The ASU will replace most existing revenue recognition guidance in U.S. GAAP when it

becomes effective. The new standard is effective for the Company on January 1, 2018. Early application is not

permitted. The standard permits the use of either the retrospective or cumulative effect transition method. The

Company is evaluating the effect that ASU 2014-09 will have on its consolidated financial statements and related

disclosures. The Company has not yet selected a transition method nor has it determined the effect on its

ongoing financial reporting.

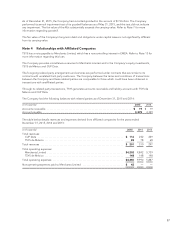

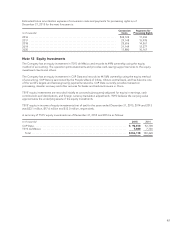

Note 2 Discontinued Operations

In accordance with GAAP, the Company determined its Japan-based businesses became discontinued

operations in the first quarter of 2014.

The Company sold all of its stock of GP Network Corporation (GP Net) (representing 54% ownership of the

company) and all of its stock of TSYS Japan Godo Kaisha (TSYS Japan) (representing 100% ownership of the

company) in April 2014. Both entities were part of the International Services segment. The sale of the Company’s

stock in both of its operations in Japan was the result of management’s decision during the first quarter of 2014

to divest non-strategic businesses and focus resources on core products and services. In 2014, the Company had

a gain of $48.6 million, net of tax, related to the sales of its operations in Japan. In 2015, the Company recorded

an additional gain of $1.4 million, net of tax, related to the return of cash that was placed in escrow during

closing and tax adjustments associated with the transaction.

GP Net and TSYS Japan were not significant components of TSYS’ consolidated results.

The following table presents the main classes of assets and liabilities held for sale as of December 31, 2014:

(in thousands) 2014

Total assets .............................................................................. $4,003

Total liabilities ........................................................................... 4,003

55