NetSpend 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

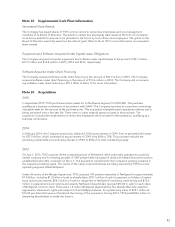

The identifiable intangible assets had no significant estimated residual value. These intangible assets are being

amortized over their estimated useful lives of five to eight years based on the pattern of expected future

economic benefit, which approximates a straight-line basis over the useful lives of the assets. The fair value of the

acquired identifiable intangible assets of $480.1 million was estimated using the income approach (discounted

cash flow and relief from royalty methods) and cost approach. The fair values and useful lives of the identified

intangible assets were primarily determined using forecasted cash flows, which included estimates for certain

assumptions such as revenues, expenses, attrition rates and royalty rates.

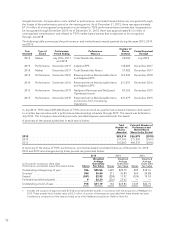

The estimated fair value of identifiable intangible assets acquired in the acquisitions and the related estimated

weighted average useful lives are as follows:

(in thousands) Fair Value

Weighted Average

Useful Life

(in years)

Channel relationships .................................................. $317,000 8.0

Current technology .................................................... 78,711 7.0

Trade name .......................................................... 44,000 5.0

Database ............................................................ 28,000 5.0

Covenants-not-to-compete ............................................. 11,500 6.0

Favorable lease ....................................................... 875 4.9

Total acquired identifiable intangible assets .............................. $480,086 7.3

The fair value measurement of the identifiable intangible assets represents Level 2 and Level 3 measurements.

Key assumptions include (a) cash flow projections based on market participant and internal data, (b) a discount

rate of 11%, (c) a pre-tax royalty rate range of 2.5-7.0%, (d) attrition rates of 5%-40%, (e) an effective tax rate of

40%, and (f) a terminal value based on a long-term sustainable growth rate of 3%.

In connection with the acquisition, TSYS incurred $3.2 million and $14.2 million in acquisition-related costs

primarily related to professional legal, finance, and accounting costs for the years ended December 31, 2014 and

2013, respectively. These costs were expensed as incurred and are included in selling, general and administrative

expenses on the income statement.

85